[ad_1]

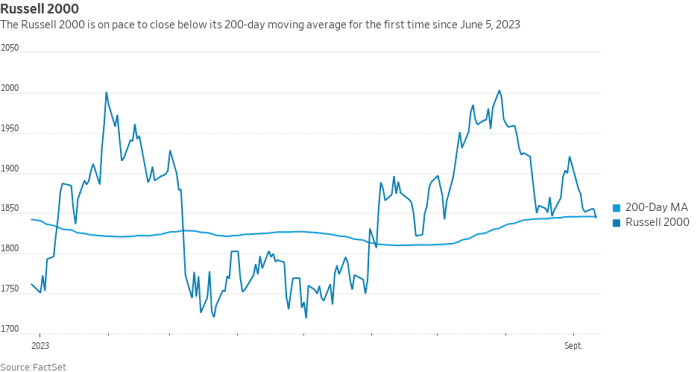

A continued bout of small-cap underperformance in the face of renewed “higher-for-longer” interest rate expectations saw the benchmark Russell 2000 stock-market index threaten an important support level on Wednesday.

The small-cap benchmark

RUT,

made up of the 2,000 smallest companies by market capitalization in the Russell 3000

RUA,

was down 0.6% near 1843.60 in afternoon trade. A finish below 1,845.76 would mark the index’s first close under the technically important 200-day moving average since June 5, according to Dow Jones Market Data.

The index traded at a session low of 1,842.99 earlier Wednesday (see chart below).

Dow Jones Market Data

Through Tuesday, the index has spent 68 trading days above its 200-day moving average, its longest since a run of 226 trading days that ran from Sept. 25, 2020, to Aug. 18, 2021.

The 200-day average is a metric often viewed by traders and technical analysts as a signal of a market’s long-term trend.

The Russell 2000 has lagged well behind the large-cap S&P 500

SPX

in September and for the year to date. The small-cap index is off 2.7% so far this month and has gained 5% in the year to date. It’s up 0.9% year over year. The S&P 500 is down 0.7% so far in September, but has rallied 16.6% in 2023 and is up 13.8% from its level a year ago.

Gains for the large-cap indexes have been driven primarily by the artificial-intelligence spawned rally in megacap tech stocks. Investors looking for the rally to broaden out have been optimistic small-cap stocks, which tend to be more oriented to the economic cycle, would benefit as fears of a recession or so-called hard landing as a result of the Federal Reserve’s aggressive monetary tightening campaign gave way to resilient data.

The weakness has come “despite all the talk this year about better-than-expected economic data and the possibility of a soft landing,” said Sameer Samana, senior global market strategist at Wells Fargo Investment Institute, in a note earlier this week.

Underperformance has accelerated, perhaps due in part to the regional banking woes in the spring, which further tightened credit and financial conditions for small businesses and is likely to spawn new regulations for small and midsized banks, the strategist said.

“While we expect small-caps to eventually have their day in the sun (probably during the next economic upturn), we believe it is much too soon to add exposure to these companies,” Samana wrote. “The fall historically has tended to be a seasonally

weak period for equities, and lingering inflation threatens to push the Fed to raise rates to higher levels and keep them longer, which increases the risk of a policy mistake and adds to the uncertainty that markets face.”

Source link