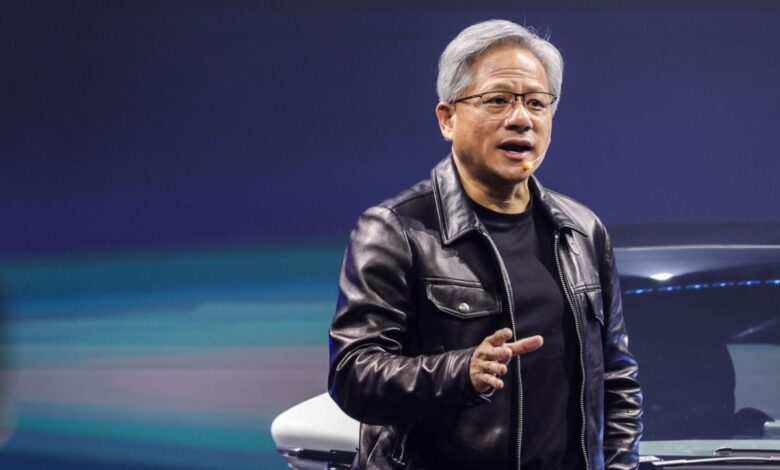

Nvidia CEO Jensen Huang says his AI powerhouse is ‘always in peril’ despite a $1.1 trillion market cap: ‘We feel it’

[ad_1]

Nvidia is on a tear. It is also, according to its billionaire CEO Jensen Huang, in peril.

The semiconductor maker, whose processors are used in gaming, data centers, and autonomous vehicles, plays a key role in the artificial-intelligence boom that has rejuvenated Silicon Valley. Tech giants compete to buy up its expensive AI chips. This year it joined the select group of companies with a market cap of $1 trillion more.

But “there are no companies that are assured survival,” Huang warned Thursday at the Harvard Business Review’s Future of Business event.

Nvidia in its 30-year history has faced several existential threats, which helps explain why Huang recently told the Acquired podcast that “nobody in their right mind” would start a company. For example, it almost went bankrupt in 1995 after its first chip, the NV1, failed to attract customers. It had to lay off half its employees before the success of its third chip, the RIVA 128, saved it a few years later.

“We have the benefit of building the company from the ground up and having not-exaggerated circumstances of nearly going out of business a handful of times,” Huang said this week, as Observer reported. “We don’t have to pretend the company is always in peril. The company is always in peril, and we feel it.”

But Huang thinks it’s important to avoid getting too stressed about it.

“I think the company living somewhere between aspiration and desperation is a lot better than either [being] always optimistic or always pessimistic,” he noted.

One challenge the Santa Clara, Calif.-based chipmaker now faces is the tightening of U.S. rules on tech exports to China. That could result in Nvidia losing billions of dollars after canceling planned deliveries to Chinese companies.

“The restriction is a capability restriction,” Huang said. “It’s not an absolute restriction…The first thing we need to do is to comply with the regulation and understand what the limits are and, to the best of our ability, offer products that can still be competitive.”

But trying to sell chips with decreased capabilities in China leaves Nvidia more exposed to competition from local rivals. “It’s not easy, and competitors are moving quickly,” Huang said. “It’s like anything else that you gotta stay alert and do the best you can.”

Meanwhile despite Nvidia blowing past expectations in recent quarters, many analysts warn that competition from rival AMD and others is sure to intensify. Among them is David Trainer, chief of research firm New Constructs.

“The rest of the world won’t just roll over and let them dominate AI,” Trainer told Fortune in August. “They’re facing the same curse as Tesla. Nvidia benefited like Tesla from being first to market. But when Tesla got profitable, loads of competitors entered the EV space, cutting its margins and slowing sales. The same will happen for Nvidia.”

Huang told Acquired that he’s read the business books by former Intel CEO Andrew Grove, calling them “really good.” Among those is Only the Paranoid Survive.

Huang seems to have taken it to heart.

“If you don’t think you are in peril,” he said this week, “that’s probably because you have your head in the sand.”

This story was originally featured on Fortune.com

Source link