[ad_1]

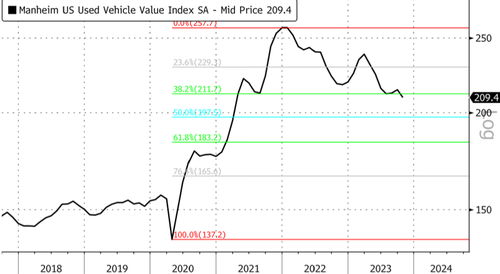

Auto research firm Cox Automotive – the owner of the closely followed Manheim price index – published new data this week for October that shows wholesale used-vehicle prices continue to slide and have reached the lowest levels since April 2021.

The Manheim Used Vehicle Value Index stood at 209.4 in October, down 2.3% from September. The index is down 4% from a year ago. These wholesale prices filter into the retail side of the market with a slight lag.

“October revealed some not-so-spooky price moves, namely a reversal of the gains that were seen during the prior two months,” said Chris Frey, senior manager of Economic and Industry Insights for Cox Automotive.

Frey continued, “This confirms the caution that was mentioned last month The UAW strike, avoiding one action that could have led to higher wholesale prices. October’s price decline is eerily similar to last October’s 2.2% drop, and this was not unexpected as the market remains balanced. Wholesale vehicle values typically experience some modest increases during the holiday season, and with two months remaining, we could see some upward price movements.”

Charles Schwab Chief Investment Strategist Liz Ann Sonders was the first to point out on social media platform X that the Manheim price index has “extended its maximum drawdown to -18%, which is largest in index’s history.”

X user CarDealershipGuy said the “strikes [UAW] are over” and “now back to reality.” He said used car demand is waning.

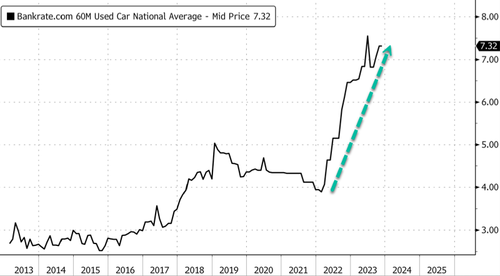

Sliding demand comes as Bankrate data shows the average borrowing rates for used cars have surged from around 3.85% in Feb. 2022 to 7.3% this month. A rate shock like this – with used car prices still above pre-Covid highs has sparked an affordability crisis among consumers.

The most significant drawdown in history for wholesale used car prices only means that more and more Americans who panic-bought cars during Covid peak will find themselves underwater in auto loans.

By Zerohedge.com

More Top Reads From Oilprice.com:

Source link