[ad_1]

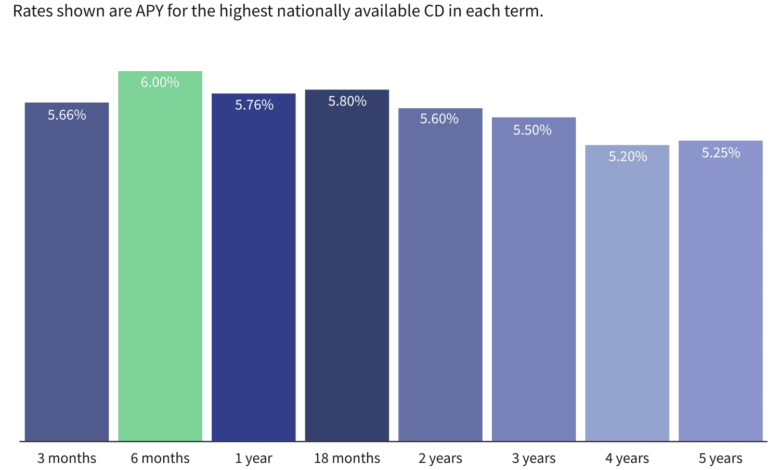

After more bad news than good on CD rates over the past two weeks, it’s nice to announce that the leading nationwide rate has bumped back into 6% territory. Although six different CDs at or above that historic threshold had graced our rankings over the past two months, all had been pulled from the market, leaving our top nationally available return at 5.80% on Friday.

Today’s new industry leader comes from Securityplus Federal Credit Union, which is paying 6.00% APY on an 8-month term. But it’s a limited-time offer, advertised as available through Nov. 30. If you’re shopping for a longer term, you may prefer one of the runners-up: either a 13-month CD from Dow Credit Union offering 5.76% APY or the 18-month certificate from Seattle Bank that pays 5.80% APY. You can also earn 5.76% APY on a 6-month certificate from TotalDirectBank.

Key Takeaways

- The top nationwide CD rate jumped back up to 6.00% today, with an 8-month offer that’s available through Nov. 30.

- There are 11 additional offers in our daily ranking of the best CDs that pay at least 5.75%.

- The top Jumbo CDs currently pay 5.85% APY, available on a 1-year certificate from either State Bank of Texas or All In Credit Union.

- Based on encouraging inflation data released last week, markets anticipate the Fed to maintain interest rates rather than raise them, suggesting that CD rates may not climb any higher—and could actually start declining.

Below you’ll find featured rates available from our partners, followed by details from our complete ranking of the best CDs available nationwide.

If you’re looking for a nationwide CD paying a top rate of at least 5.75%, the longest term available is 18 months. But if you want to secure one of today’s historically high rates for longer, you can lock in 5.60% APY for 2 years or 5.50% APY for 3 years. Still not long enough? You can get a 4-year CD with a rate of 5.20% or a 5-year CD that pays 5.25% APY.

If you have enough to make a jumbo deposit of $50,000 or $100,000, you can stretch your rate in the 1-year term—earning 5.85% from two different contenders—and the 2-year term, with a top rate of 5.68% APY.

When asked if they were choosing more or less of certain investments during recent market events in November, 28% of Investopedia readers said they were choosing CDs. This is slightly down from what readers told us in October, when 29% of investors said they were choosing CDs over stocks. Additionally, 14% of readers said they would open a CD if they had an extra $10,000 to invest, which was just behind the 15% who said they’d put it in individual stocks.

Note that jumbo CDs don’t always pay a higher return than standard certificates. Sometimes you can do just as well—or better—with a standard CD. That’s currently the case in five of the eight terms above, so it’s smart to shop both certificate types before making a final decision.

How High Will CD Rates Go This Year?

The Federal Reserve has been aggressively combating decades-high inflation since March of last year, raising the federal funds rate with fast and furious hikes in 2022 and then more moderate increases in 2023. This has created historically favorable conditions for CD shoppers, as well as for anyone holding cash in a high-yield savings or money market account.

The Fed opted to hold rates steady on Nov. 1, its second such move in a row. That maintains the central bank’s benchmark rate at its highest level since 2001. But in his post-announcement press conference, Fed Chair Jerome Powell made it clear that holding rates in place right now does not necessarily mean the committee is finished with increases.

“Inflation has moderated since the middle of last year and readings over the summer were quite favorable,” Powell said. “But a few months of good data are only the beginning of what it will take to build confidence that inflation is moving down sustainably toward our goal.”

However, monthly inflation data released last week was encouraging, coming in below expectations. As a result, financial markets now overwhelmingly predict that the Fed will not make any further rate increases, with odds for an increase at the committee’s Dec. 13 or Jan. 31 meetings down to 2%, according to the CME Group’s FedWatch Tool.

As we always caution, trying to predict the Fed’s future rate moves is an unreliable exercise. But for now, it seems CD rates are unlikely to climb and could ease down from their historic peaks.

Note that the “top rates” quoted here are the highest nationally available rates Investopedia has identified in its daily rate research on hundreds of banks and credit unions. This is much different than the national average, which includes all banks offering a CD with that term, including many large banks that pay a pittance in interest. Thus, the national averages are always quite low, while the top rates you can unearth by shopping around are often five, 10, or even 15 times higher.

Rate Collection Methodology Disclosure

Every business day, Investopedia tracks the rate data of more than 200 banks and credit unions that offer CDs to customers nationwide and determines daily rankings of the top-paying certificates in every major term. To qualify for our lists, the institution must be federally insured (FDIC for banks, NCUA for credit unions), and the CD’s minimum initial deposit must not exceed $25,000.

Banks must be available in at least 40 states. And while some credit unions require you to donate to a specific charity or association to become a member if you don’t meet other eligibility criteria (e.g., you don’t live in a certain area or work in a certain kind of job), we exclude credit unions whose donation requirement is $40 or more. For more about how we choose the best rates, read our full methodology.

Investopedia / Alice Morgan & Sabrina Jiang

Source link