[ad_1]

Recent sentiment around Nvidia (NVDA) stock is pointing to signs the stock is set for consolidation. But Dow Jones Industrial Average component Intel (INTC) could provide more immediate returns from the semiconductor sector as its price action indicates it still has room to run, according to an expert technician.

X

“Nvidia’s running out of steam,” John Bollinger, president at Bollinger Capital Management, tells Investor’s Business Daily’s “Investing With IBD” podcast. He points to Nvidia stock’s weekly price chart overlaid with Bollinger Bands as a measure of price volatility. He says the stock has probably gone too far, too fast, and is overdue for a period of consolidation.

“Nvidia’s period of big gains are way behind it,” he said.

Audio Version Of Podcast Episode

Bollinger Bands, expressed as upper and lower trend lines around price bars, are formed by calculating standard deviations from a stock’s simple moving average. They are used by many technical traders to determine whether a stock is oversold or overbought.

Intel Stock Shapes Up As Underdog To Nvidia Stock

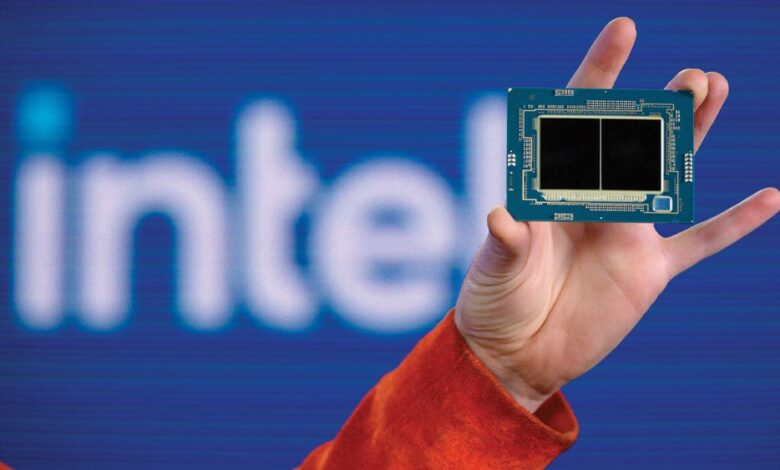

That technical indicator is pointing to a potential comeback by now-underdog chipmaker Intel, a Dow Jones component. Bollinger likens Intel to IBM (IBM), blue chip stocks that could be shifting from income generators to vehicles for capital gains in the current market environment. “We see both of those with substantial upside in front of them,” he said.

There are still some macro pitfalls to watch for in Intel and Nvidia stock, like the ongoing chip wars and trade relations between the U.S. and China. The issues are real and worth paying attention to, especially given tech’s fickleness in crowning winners and losers at times. “We look for signs of technology deterioration, which we haven’t seen yet,” said Bollinger.

But Bollinger sees reasons for cheerfulness in Intel’s fundamentals. “I think people are going to appreciate Intel for some of the things that it can do, and that could potentially be a positive factor for the stock in the long haul,” he says.

“It’s building fabs, building them quickly, and doing a good job of that,” said Bollinger of the Dow Jones chip stock.

IBD’s approach to stock analysis sees Intel as extended from a proper buy point for the time being. Shares broke out of a base with a 40.07 buy point in above-average volume on Nov. 15 and are now 12% above that buy point in 11 days.

Check out this week’s podcast episode for detailed analysis of Nvidia stock, Intel stock and other insights from John Bollinger.

YOU MAY ALSO LIKE:

IBD Live: Follow The Market With Investing Experts

Investors Are Placing Big Bets On DraftKings Stock. Here’s Why.

Top 4 Takeaways For Stocks With China Exposure After Historic Biden-Xi Meeting

Shopify Stock Sees Momentum After Explosive Earnings, But When’s The Next Chance To Buy?

Source link