[ad_1]

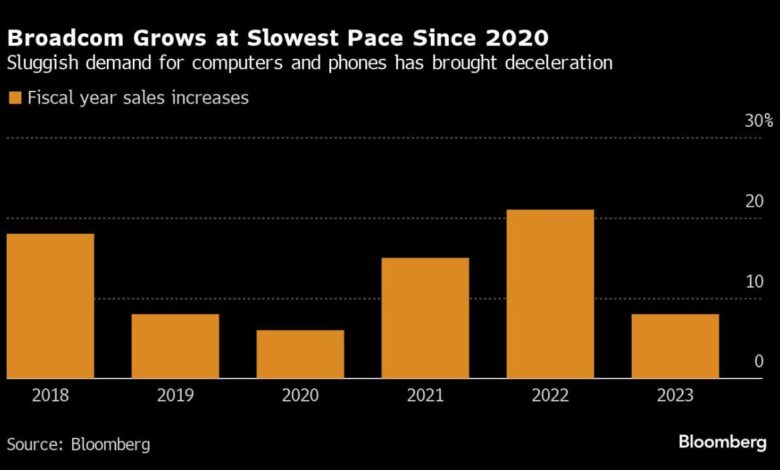

(Bloomberg) — Broadcom Inc., a chip supplier for Apple Inc. and other big tech companies, expects the rapid expansion of artificial intelligence computing to help offset its worst slowdown since 2020.

Most Read from Bloomberg

Revenue from networking semiconductors used to support AI systems now accounts for 15% of the company’s total chip sales, and that portion will grow to more than 25% in fiscal 2024, Broadcom said Thursday after releasing its quarterly results.

The prospect of AI growth helped cheer investors, who initially sent the shares down after the report was released. Broadcom sales are growing at the slowest pace since the early days of the pandemic, with corporate customers and telecom providers reining in their spending.

AI is a bright spot, according to Chief Executive Officer Hock Tan. Spending on computer networks needed to support those services are expected to double, he said on a conference call. So far, fellow chipmaker Nvidia Corp. has seen the biggest windfall from the AI boom, which has propelled its valuation past the $1 trillion mark this year.

Tan’s remarks helped the shares recover after a drop of 3.6% in late trading. The stock was little changed as of 6 p.m. New York time, at $922.

Revenue grew 4% to $9.3 billion in the fourth quarter, which ended Oct. 29. Broadcom, which just bought VMware Inc. for more than $60 billion, predicted that its 2024 revenue would be about $50 billion when including that acquisition.

Though that number appeared to be below the two companies’ combined sales estimates, Broadcom plans to spin off two VMware units. They would account for about $2 billion in sales.

For the 11 months remaining in fiscal 2024, VMware will contribute about $12 billion to total revenue, executives said. It will take about a year to fully integrate VMware, but growth will then accelerate as the company focuses on more high-value products, Tan said.

In the coming year, the company expects mid- to high-single-digit percentage growth in semiconductors. That’s a slowdown from the preceding two years.

In the fourth quarter, Broadcom’s profit was $11.06 a share, excluding some items. Analysts had predicted earnings of $10.93 a share.

Broadcom’s chip business had sales of $7.33 billion in the fourth quarter, in line with estimates. Infrastructure software revenue was $1.97 billion, versus a projection of $1.94 billion.

Broadcom provides key components for Apple’s iPhone, designs custom chips for Alphabet Inc.’s Google and is the biggest supplier of networking components that direct traffic between computers in data centers.

Tan emphasized that his company’s relationship with Apple, which he refers to as his “North American customer,” will continue to be strong. Revenue from the division that provides Apple with connectivity chips will be stable next year, he said.

Tan is also betting on software to maintain growth. The company completed the VMware deal last month, gaining a bigger foothold in so-called hybrid cloud services, which cater to companies that store data both in their own facilities and outside server farms.

Broadcom expects the VMware integration to cost $1.3 billion through fiscal 2025, according to a filing. The chipmaker has been cutting jobs and moved its headquarters to Palo Alto, California, where VMware was based, from nearby San Jose.

(Updates with CEO remarks starting in fourth paragraph.)

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.

Source link