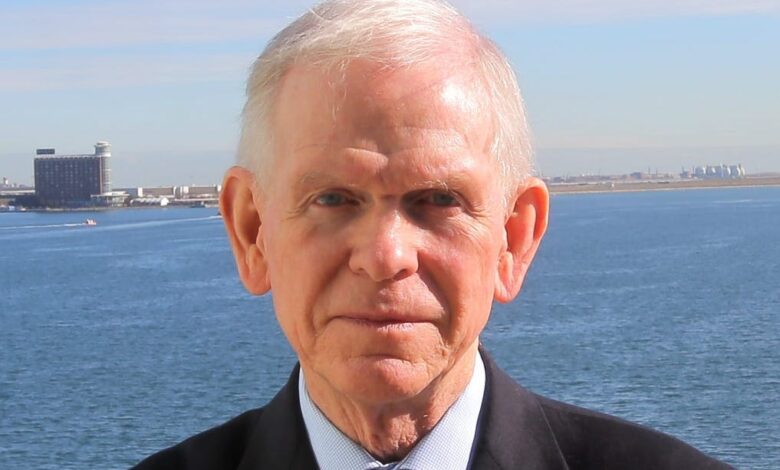

Legendary investor Jeremy Grantham warns of a ‘superbubble’ and looming recession — and touches on Elon Musk and housing woes

[ad_1]

-

Jeremy Grantham warned a “superbubble” in asset prices would likely end in a painful recession.

-

The veteran investor discussed housing affordability and income inequality in a recent interview.

-

Grantham also touched on Elon Musk, the Fed, his own net worth, and the meme-stock mania of 2021.

Jeremy Grantham rang the alarm again on a “superbubble” in financial markets, and warned its popping would likely herald a harsh recession, during a recent episode of “The Great Simplification” podcast.

The GMO cofounder and market historian touched on everything from his own net worth to Elon Musk, the need for Fed reform, housing affordability, income inequality, and the meme-stock craze in 2021.

Here are Grantham’s 9 best quotes, lightly edited for length and clarity:

1. He got into finance for fun

“I got into finance for a very profound reason, and that was I asked which of my classmates from business school were having the most fun? Back then in 1968, by a very wide margin, the guys in the stock market were having the most fun. So I thought, ‘Well, I don’t want to miss out on that.’ They were not only having more fun, but they were getting paid a hell of a lot more money. What’s not to like about that?”

2. On not really being a billionaire

“I am only a billionaire by a strange and generous construction, and that is if you count the money I have given away, which is a pretty whimsical way of calculating someone’s net worth. But in terms of what I actually have and could go out and buy my daughter back from being kidnapped tomorrow, I’m at least an order of magnitude short of that.”

3. On meme stocks in 2021

“In 2021, we had utterly crazy behavior. I believe if you look at the scale of it, the biggest, most significant crazy behavior in recorded history of the US stock market.” (Grantham was referring to the mass hype and speculation around meme stocks, SPACs, crypto, NFTs, and other risky assets.)

4. On the risk of a superbubble

“Superbubbles go back to trend like all the normal bubbles, but they cause a whole lot more pain because they distort the system. When they inevitably break, they’re always a shock because everyone has locked into the new paradigm. They eventually come down to trend, and all but one of them in history go below trend for a while, and that creates an enormous negative income effect and has always caused a recession.” (Grantham has repeatedly cautioned the S&P 500 could crash by over 50%.)

5. The economy is in for a bad ride

“If you miscalculate, the recession turns into something really terrible like the depression of 1929, like the bitter recession of the Nifty 50 in the ’70s, or the near total financial collapse of the housing bust in ’08. And one should expect something pretty bad this time. We await to see if this follows the pattern of history, or whether it is indeed that lovely creature, a new paradigm. But history is not kind to the new paradigm thinking.”

6. America’s income inequality is severe

“An enlightened government will move to make sure that there is a fairly broad, acceptable income distribution. We are already falling foul of that. Our income distribution in the US is no longer passing that test. It has resulted in the estrangement, almost bitterness and anger of at least a third of the general public who feels they have been badly treated. I think you could make a pretty good case that, yes, they have been royally screwed since about 1975.”

7. There’s good and bad capitalism

“The people who start their own darn firm like Mr. Musk, in a sense they deserve what they get. People who start a new enterprise, when you’ve paid all the rent and you’ve paid all the salaries, what’s left is yours. I get that. That’s capitalism. It’s the best part of capitalism. When you put a bunch of your buddies on the board, and you decide to give yourself $200 million of stock options over three years because they’re your friends, that isn’t capitalism. That is stock-option culture gone wrong.”

8. Everything is unaffordable

“Buying a house, it’s such a high unaffordability index now. Peak prices as a multiple of family income times 7.8% mortgage, that is a brutal increase in your cost. So cars, houses, and real life, this is not a super comfortable world for everyone below halfway on the income scale.”

9. On the Fed

“I think the Fed has been given far too many responsibilities. If it was just responsible for making sure there was a decent amount of money available … but it’s worried about inflation, about growth, about debt, unemployment. It’s pretty well guaranteed it will settle for some simple policy of making rates cheap. Cheap rates were terrible for retirees, they were not getting paid anything.”

Read the original article on Business Insider

Source link