[ad_1]

Alphabet (NASDAQ: GOOGL)(NASDAQ: GOOG) stock posted another day of significant gains in Monday’s trading. The tech giant’s share price closed out the daily session up 2.4%, according to data from S&P Global Market Intelligence.

Alphabet’s stock gained ground today, trading amid a spurt of broader momentum for big tech stocks with significant exposure to artificial intelligence (AI) trends. Even on the heels of big gains across 2023’s trading, Wall Street appears to be becoming increasingly bullish on the long-term prospects for the market’s biggest AI stocks.

Big Tech’s big rally keeps rolling

Thanks to its position as a leading provider of web-search services through its Google platform, Alphabet stands to benefit from artificial intelligence services improving search and digital advertising results. However, the company’s opportunities to benefit from AI are hardly limited to the Google search platform.

Beyond its market-leading search engine services, Alphabet also has strong positions in mobile operating system software, cloud infrastructure services, video streaming, and other influential product categories. Alphabet’s varied and far-reaching ecosystem of products and services gives the company a wide range of ways to benefit from the rise of artificial intelligence. The tech giant’s diverse product suite also generates an incredible amount of data, which can be used to generate valuable insights and improve the performance of AI algorithms.

Is Alphabet stock a buy right now?

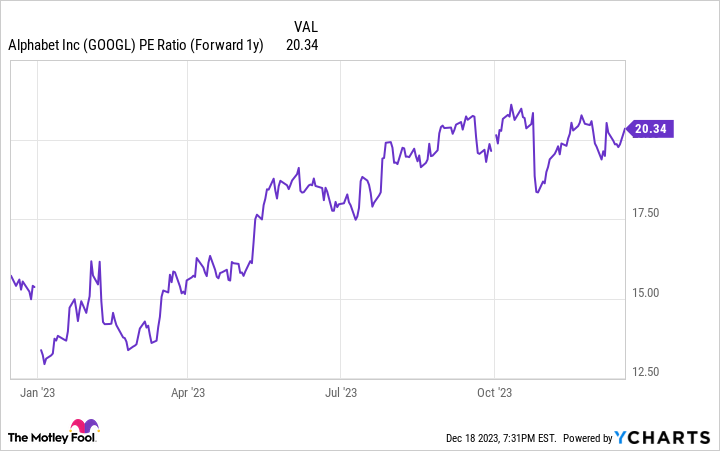

Alphabet stock has already climbed roughly 54% across 2023’s trading, but that doesn’t mean long-term investors should ignore the stock. The company still trades at reasonable earnings multiples, and it could deliver strong returns for those who take a buy-and-hold approach at today’s prices.

Valued at roughly 20 times next year’s expected earnings, Alphabet stock still has the potential to deliver market-beating gains for patient investors. Thanks to their existing infrastructure and data-generating advantages, large tech companies have big advantages in the AI race.

While the extent to which Alphabet will be able to leverage these strengths still remains to be seen, the company’s position in artificial intelligence and the broader tech industry continues to look quite strong. For long-term investors seeking ways to play AI and technology trends, Alphabet stock looks like a worthwhile portfolio addition, even on the heels of recent gains.

Should you invest $1,000 in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 18, 2023

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet. The Motley Fool has a disclosure policy.

Alphabet Jumped Again Today Thanks to AI — Is the Stock a Buy? was originally published by The Motley Fool

Source link