3 “Magnificent Seven” Stocks With 50% to 122% Upside in 2024 (and Beyond), According to Select Wall Street Analysts

[ad_1]

In a little over one week, the curtain will close on what’s been a truly banner year for Wall Street. The iconic Dow Jones Industrial Average has climbed to a fresh record high, while the benchmark S&P 500 and growth-driven Nasdaq Composite have powered higher by 24% and 43%, respectively, on a year-to-date basis, as of the closing bell on Dec. 19.

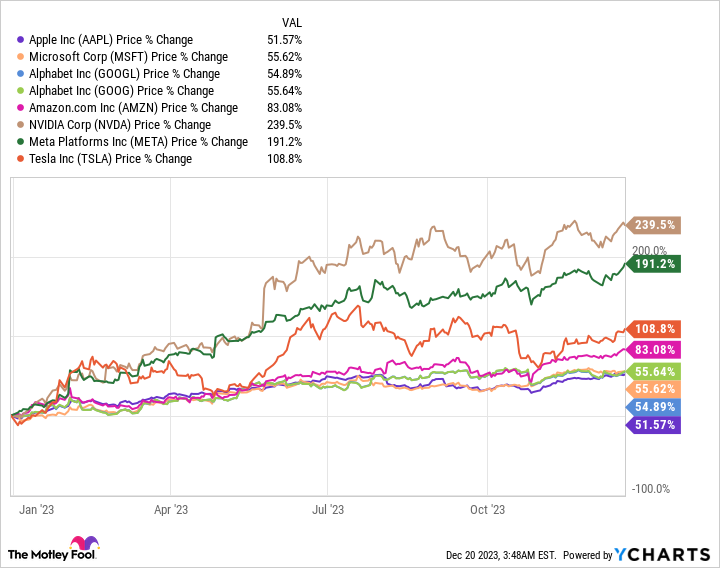

Although the rally over the past eight weeks has been broad-based, it’s the “Magnificent Seven” that have done most of the heavy lifting on Wall Street since the year began.

The Magnificent Seven are comprised of the seven largest publicly traded companies by market cap in the U.S.:

The reason the Magnificent Seven have outperformed so substantially this year is because of their respective impenetrable moats and/or competitive advantages.

-

Apple boasts the greatest capital-return program on the planet and is the leading provider of smartphones (by a mile!) in the U.S.

-

Microsoft’s Windows still dominates desktop operating systems, while Azure is the global No. 2 in cloud infrastructure-service spending.

-

Alphabet’s Google is practically a monopoly, with nearly 92% of worldwide internet search share in November.

-

Amazon’s online marketplace brought in roughly $0.40 of every $1 spent in online retail sales in the U.S. in 2022.

-

Nvidia’s graphics processing units (GPUs) account for between 80% and 90% of the GPUs currently deployed in high-compute data centers.

-

Meta Platforms owns the world’s top social media “real estate” (led by Facebook), and it drew in close to 4 billion monthly active users during the third quarter.

-

Tesla is North America’s leading electric vehicle (EV) manufacturer and the only EV pure play that’s currently profitable.

The cutting-edge innovation and sustained dominance exhibited by these seven companies isn’t lost on Wall Street or its analysts. Based on the high-water price targets issued by a select group of analysts, three Magnificent Seven stocks have upside ranging from 50% to 122% in 2024 (and beyond).

Nvidia: Implied upside of 122%

Even though shares of semiconductor stock Nvidia have gained nearly 240% year to date, at least one Wall Street analyst sees triple-digit upside still to come.

According to Hans Mosesmann of Rosenblatt Securities, Nvidia can reach $1,100 per share, which would represent a gain of 122% for the company’s shareholders. If Mosesmann is correct, it would also add another $1.5 trillion to Nvidia’s market cap.

It’s absolutely no secret that the buzz surrounding Nvidia has to do with its ties to the rise of artificial intelligence (AI). Analysts at PwC have estimated that AI can add $15.7 trillion to the global economy by the turn of the decade. Nvidia is cementing itself as the infrastructure backbone of this close-to-$16 trillion opportunity.

Nvidia’s A100 and H100 AI-driven GPUs could potentially top a 90% share in AI-accelerated data centers in 2024. Though chip-on-wafer-on-substrate (CoWoS) capacity held the supply of A100 and H100 GPUs back throughout much of the current year, chip-fabrication giant Taiwan Semiconductor Manufacturing has increased its CoWoS capacity and paved a path for Nvidia to meaningfully increase output in the new year.

However, Nvidia’s newfound success may come with an ironic problem. You see, the bulk of Nvidia’s data-center sales growth through the first nine months of its current fiscal year was driven by A100 and H100 scarcity and truly exceptional pricing power. As Nvidia ramps up production, and new competition enters the arena (ahem, Advanced Micro Devices), Nvidia is liable to lose most of its pricing power. In other words, Nvidia’s gross margin may have already peaked.

Furthermore, there hasn’t been a next-big-thing investment for three decades that didn’t endure a period of unsustainable euphoria early in its ramping up — and AI is unlikely to be the exception. Most businesses are still trying to figure out how to deploy AI solutions to their advantage. Using history as a guide, it’s highly unlikely that Mosesmann’s $1,100 price target for Nvidia is reached in 2024.

Microsoft: Implied upside of 61% (over three years)

The second Magnificent Seven stock with mouthwatering upside, based on the prognostication of one Wall Street analyst, is tech stock Microsoft.

Analyst Joel Fishbein of Truist Securities recently anointed the second-largest publicly traded company by market cap with a $600 price target over the next three years. Should Fishbein’s forecast come to fruition, Microsoft’s shares would increase by 61%, with the company adding almost $1.7 trillion in market cap.

It should come as no surprise that Microsoft’s burgeoning investments in AI are the primary driver of Fishbein’s lofty price target. Microsoft has invested billions into OpenAI, the company that introduced the world to ChatGPT one year ago. OpenAI also played a key role in the incorporation of AI into Microsoft’s search engine, Bing.

Additionally, Microsoft was quick to introduce generative AI solutions to its cloud-infrastructure service customers via Azure. Generative AI solutions are particularly useful for businesses in that they can tailor marketing to specific customers, provide virtual agents/chatbots that can answer customer queries, and can even offer solutions for supply chain inefficiencies. It’s no wonder Azure has been gaining ground in the cloud-infrastructure service space.

However, Microsoft’s legacy segments are still playing a key role in its success. Though Windows isn’t the growth driver it was 20 years ago, it’s still the dominant global operating system for computers. The high margins and abundant cash flow Microsoft nets from its legacy operations provides the company with capital to take risks — e.g., make acquisitions or invest aggressively in new trends, like AI.

Although Microsoft shouldn’t have any trouble sustaining a low-double-digit growth rate, the company’s stock presently appears fully priced for future success (29 times forward earnings). This makes Fishbein’s $600 price target over the next three years a potential reach.

Amazon: Implied upside of 50%

The third Magnificent Seven stock with abundant upside in 2024 (and potentially beyond) is e-commerce juggernaut, Amazon.

According to analyst Alex Haissl of Redburn Atlantic, the world’s leading online retailer is expected to reach $230 per share. Should Haissl’s forecast become reality in the new year, Amazon shares would increase by 50%, and its market cap would grow by close to $790 billion.

The likely catalyst behind Haissl’s aggressive price target for Amazon is the company’s fast-growing cloud-infrastructure services segment. Despite Azure gaining a bit of ground, Amazon Web Services (AWS) remains the world’s top cloud-infrastructure service provider by spending (31% share). Considering that enterprise cloud spending is still in its very early innings of expansion, there’s reason to believe AWS can deliver significant operating cash-flow growth for Amazon in the years to come.

Amazon’s other fast-growing ancillary segments provide another reason to be optimistic about its future. For instance, Amazon attracts more than 2 billion unique visitors to its site each month, which makes it one of the most visited sites globally. This makes the company a logical go-to for advertisers wanting to get their message(s) in front of motivated shoppers. It’s the perfect recipe for strong ad-pricing power.

Likewise, Amazon surpassed 200 million global Prime subscribers in April 2021. The steady expansion of the company’s e-commerce platform, coupled with it gaining the exclusive rights to Thursday Night Football, has likely pushed Prime’s subscriber count meaningfully higher.

The final selling point for Amazon is the company’s valuation. Even though its trailing-12-month price-to-earnings ratio of 81 is enough to make even the most aggressive growth investors cringe, its forward-year multiple-to-cash flow (14) is lower than at any point since becoming a publicly traded company. Among the Magnificent Seven stocks with the greatest upside potential in 2024 (and beyond), it’s Amazon that’s likeliest to reach its high-water price target.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 18, 2023

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Sean Williams has positions in Alphabet, Amazon, and Meta Platforms. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, Taiwan Semiconductor Manufacturing, Tesla, and Truist Financial. The Motley Fool has a disclosure policy.

3 “Magnificent Seven” Stocks With 50% to 122% Upside in 2024 (and Beyond), According to Select Wall Street Analysts was originally published by The Motley Fool

Source link