[ad_1]

(Bloomberg) — European and US stock futures fell on speculation investors are trimming positions before the release of a US inflation gauge that may help shape the outlook for Federal Reserve policy.

Most Read from Bloomberg

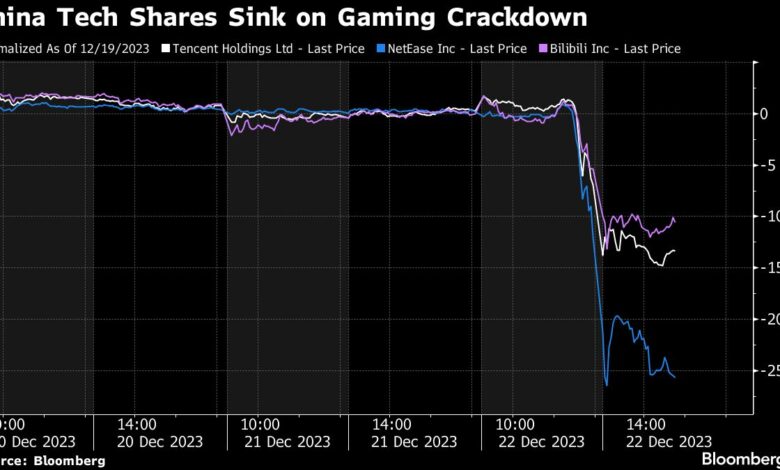

Shares in Asia slipped after China announced new curbs on online gaming, pummeling some of the region’s largest technology shares including Tencent Holdings Ltd. and NetEase Inc. Oil extended its biggest weekly gain in two months as shippers avoided the Red Sea amid increased attacks, while Angola’s exit from OPEC after 16 years put the spotlight on the group’s unity.

The US core personal consumption expenditures price index probably fell to 3.3% in November from 3.5% the previous month, according to a Bloomberg survey of economists before the numbers are released later Friday.

“The focus today is on core PCE tonight and one should be mindful of the razor-thin liquidity heading into the festive season as data surprise may exacerbate price movement,” said Christopher Wong, a foreign-exchange strategist at Oversea-Chinese Banking Corp. in Singapore.

Asian shares gave up earlier gains after technology shares in Hong Kong plummeted when China unveiled a slew of new measures to rein in spending and content in online games. The sweeping restrictions suggest Beijing is getting ready to launch another crackdown on the world’s largest mobile gaming arena.

Treasuries traded in tight ranges before the PCE data, while the dollar rose against most of its Group-of-10 peers and gold was on track for a weekly gain.

Swaps traders are pricing in around 150 basis points of Fed cuts next year, twice as much as the central bank has signaled as US GDP growth was revised lower Thursday to a 4.9% annualized reading in the third quarter. Personal consumption data also came in softer than economists had anticipated.

In corporate news, Sumitomo Life Insurance Co. agreed to buy TPG Inc.’s stake in Singapore Life Holdings Pte as the Japanese insurer seeks to bolster its presence in Southeast Asia. The acquirer will pay $1.2 billion to purchase the roughly 35.5% stake.

Nike’s shares fell more than 10% in late trading after the company said it’s looking for as much as $2 billion in cost savings by dismissing workers and simplifying the apparel giant’s product assortment amid a weaker sales outlook.

Key events this week:

-

UK GDP, Friday

-

US personal income and spending, new home sales, durable goods, University of Michigan consumer sentiment index, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures fell 0.2% as of 6:34 a.m. London time

-

S&P/ASX 200 futures were little changed

-

Hong Kong’s Hang Seng fell 1.6%

-

The Shanghai Composite fell 0.3%

-

Euro Stoxx 50 futures fell 0.1%

-

Nasdaq 100 futures fell 0.3%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro fell 0.1% to $1.0999

-

The Japanese yen was little changed at 142.26 per dollar

-

The offshore yuan was unchanged at 7.1555 per dollar

-

The Australian dollar fell 0.4% to $0.6777

-

The British pound was little changed at $1.2687

Cryptocurrencies

-

Bitcoin rose 0.5% to $44,233.85

-

Ether rose 1.8% to $2,289.3

Bonds

-

The yield on 10-year Treasuries was little changed at 3.89%

-

Japan’s 10-year yield advanced 3.5 basis points to 0.620%

-

Australia’s 10-year yield was little changed at 4.01%

Commodities

-

West Texas Intermediate crude rose 0.8% to $74.50 a barrel

-

Spot gold rose 0.1% to $2,048.07 an ounce

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.

Source link