[ad_1]

Nvidia (NASDAQ: NVDA) has been a home run investment in 2023. Shares of the semiconductor giant have more than tripled this year, gaining a whopping 238% thanks to an astronomical acceleration in the company’s revenue and earnings. Booming demand for its graphics cards is playing a major role in training artificial intelligence (AI) models.

The good news is that analysts are anticipating Nvidia stock to head higher in 2024. According to 46 analysts covering the stock, Nvidia has a median 12-month price target of $650. That points toward a 35% jump from current levels. The Street-high price target sits at $1,100, which points toward a 123% jump over the next year.

Let’s find out if Nvidia can outpace the median stock price target and double in 2024 from current levels of around $480.

Nvidia is expected to deliver another year of terrific growth in 2024

Nvidia’s revenue stands at almost $39 billion in the first nine months of fiscal 2024. Its guidance for $20 billion in revenue in the current quarter means that it will finish the fiscal year (which ends next month) with a top line of $59 billion. That would be a 118% jump over Nvidia’s fiscal 2023 revenue.

Consensus estimates, however, indicate that Nvidia could finish the year with $54 billion in revenue. Analysts are expecting $18.4 billion in revenue from the company in the ongoing quarter, which is well below its guidance. There is a good chance that Nvidia could easily crush Wall Street’s expectations given that its AI graphics cards are selling like hotcakes.

The company reportedly sold half a million units of its popular A100 and H100 data center GPUs (graphics processing units) in the previous quarter, according to Omdia, and it is expected to exceed that mark in the current quarter. So, Nvidia stock could get a nice boost in February next year, when its fiscal 2024 fourth-quarter results are due, by delivering better-than-expected sales growth.

More importantly, Nvidia is setting itself up to sustain its impressive growth momentum through 2024 by focusing on expanding its manufacturing capacity and encouraging its foundry partner to produce more chips. For instance, Nvidia is reportedly mulling partnerships with Vietnam and Malaysia to manufacture more chips. At the same time, foundry partner Taiwan Semiconductor Manufacturing, popularly known as TSMC, is reportedly going to open a new fabrication plant in Japan in February 2024 and plans to add two more fabs.

Moreover, TSMC is already working on the expansion of its advanced chip packaging capacity in a bid to make more AI chips. Based on this, Tianfeng Securities analyst Ming-Chi Kuo is anticipating a massive jump of 150% in Nvidia’s AI graphics card shipments in 2024. The launch of two new AI GPUs in the form of the H200 and the next-generation Blackwell B100 cards, as well as the big backlog of Nvidia’s current graphics cards, could play an instrumental role in driving such solid growth in shipments.

Nvidia’s data center business has generated $29 billion in revenue in the first three quarters of fiscal 2024, accounting for almost three-fourths of its top line. The company’s $20 billion revenue estimate for the current quarter indicates that it could generate $15 billion in revenue from this segment in fiscal Q4 and end the year with data center revenue of $44 billion.

Assuming the 150% jump in shipments of data center GPUs next year translates into an identical jump in revenue, the company could generate a whopping $110 billion in sales from this segment alone. That would be significantly higher than analysts’ expectations of $85 billion in revenue from Nvidia in fiscal 2025 (which will coincide with 11 months of calendar 2024).

Why Nvidia stock seems set to double in 2024

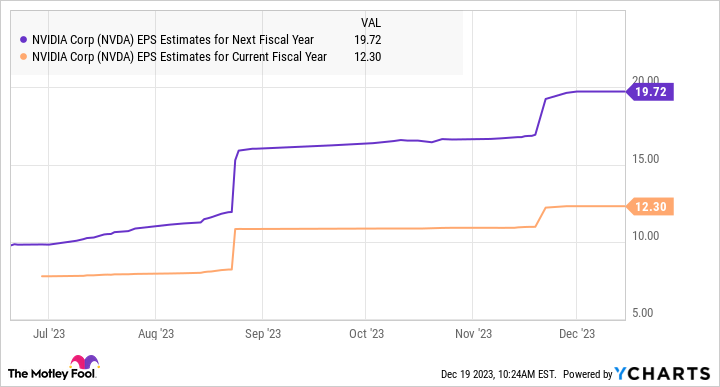

We have seen that Nvidia can outperform Wall Street’s growth expectations next year, which could help the stock deliver eye-popping gains once again. According to consensus estimates, Nvidia’s earnings could jump 60% in fiscal 2025 to $19.72 per share. That seems like a conservative view as Nvidia is on track to almost quadruple its bottom line in the current fiscal year.

But even if Nvidia’s earnings growth decelerates to a respectable 60% and indeed hits $19.72 per share, its stock price could exceed $1,000 based on the company’s forward earnings multiple of 55. So, there is a chance that this AI stock could indeed hit the Street-high price target on the back of further acceleration in the data center business, as well as emerging catalysts in the personal computer business.

As such, investors would do well to continue holding Nvidia stock in their portfolios as there is a possibility that it may double next year.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 18, 2023

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

Here’s Why Nvidia Stock Could Double in 2024 was originally published by The Motley Fool

Source link