[ad_1]

Cathie Wood, the founder and CEO of investment management company Ark Invest, is a widely followed investor on Wall Street thanks to her strategy of buying shares of companies capable of disruptive innovation, which she believes could yield solid returns in the long run.

Wood’s flagship fund, the Ark Innovation ETF, has benefited from this strategy in 2023, logging impressive gains of 70%. Of course, the famous investor’s philosophy of buying high-risk, high-reward companies also means that there will be periods of volatility, which is evident from the big beating Wood’s funds took in 2022. That explains why Wood has an investment timeline of five years, which allows her investments to ride through periods of volatility.

The good part is that Wood’s investments could benefit from a favorable stock market scenario in 2024. A potential cut in interest rates by the Federal Reserve could give growth stocks a nice shot in the arm in the New Year, which is why investors may want to buy one of Wood’s top 10 holdings before it jumps higher.

Shares of Twilio (NYSE: TWLO) have climbed 52% since the beginning of November. Let’s look at the reasons this tech stock could sustain its impressive momentum and head higher.

Twilio is sitting on a lucrative business opportunity

Twilio is the ninth largest component of the Ark Innovation ETF, and it’s worth noting that Wood and her team have been actively buying shares of this cloud communications specialist in 2023. That’s not surprising, as Twilio operates in a market that’s expected to grow at a robust pace in the long run.

Twilio’s cloud-based software platforms allow companies to communicate with their customers through multiple channels, such as text, voice, email, chat, and video. Customer service associates simply need a computer and the internet to connect with customers from anywhere in the world.

These cloud-based contact centers enjoy several advantages over traditional ones. For instance, companies don’t need to spend on infrastructure such as office space or on-site servers in the case of a cloud contact center. It’s easily scalable based on an organization’s requirements and also helps improve the customer service experience, as associates can reach customers using various channels.

Not surprisingly, the need for cloud-based contact centers is predicted to increase at a compound annual growth rate (CAGR) of 26% through 2028 and hit annual revenue of $69 billion at the end of the forecast period, according to Mordor Intelligence. That kind of performance should help Twilio come out of its recent slump, which has been triggered by a weak customer spending environment.

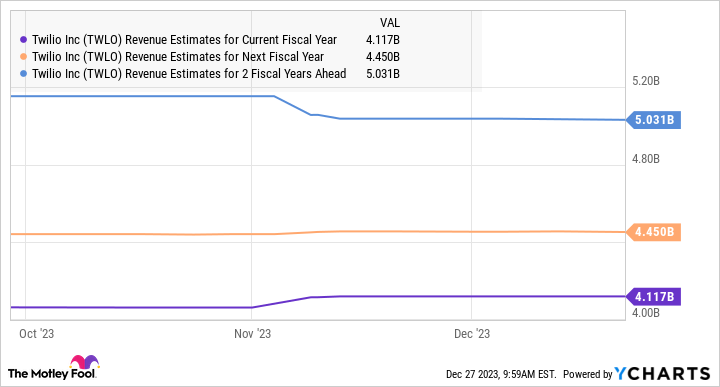

The company is expected to finish 2023 with a 7% jump in revenue to $4.1 billion, followed by an identical increase next year. However, as the following chart indicates, Twilio’s growth is predicted to accelerate from 2025.

Solid long-term upside could be on the cards

Members of Twilio management pointed out in the company’s investor-day presentation in November 2022 that they expect revenue to increase at a CAGR of 15% to 25% in the medium term. Assuming Twilio can maintain even a 15% revenue growth rate over the three-year period from 2026, its top line could jump to $7.65 billion in 2028, using the 2025 revenue estimate of $5 billion as the base.

Twilio has a five-year average sales multiple of 15. However, it’s now trading at just 3.5 times sales. Assuming it can maintain its current sales multiple after five years, Twilio’s market cap could jump to almost $27 billion, based on the $7.65 billion revenue estimate for 2028. That would be a 94% jump from current levels, suggesting that this “Cathie Wood stock” could give investors healthy returns over five years.

And finally, Twilio’s current price-to-sales ratio is significantly lower than the five-year average, which is why investors should consider buying it right away given the potential upside it could deliver in the long run.

Should you invest $1,000 in Twilio right now?

Before you buy stock in Twilio, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Twilio wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 18, 2023

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Twilio. The Motley Fool has a disclosure policy.

This Cathie Wood Stock Is Soaring Magnificently, and It Could Make You Rich Over Time was originally published by The Motley Fool

Source link