[ad_1]

How important was the so-called “Magnificent Seven” in 2023? Well, according to S&P Senior Index Analyst Howard Silverblatt, it was very important. Consider this: The Magnificent Seven — Apple, Nvidia, Amazon, Microsoft, Alphabet, Meta Platforms, and Tesla — accounted for more than 60% of the S&P 500‘s total return of 26%. Indeed, if those seven stocks were excluded, the index would have only returned 7.6%, making 2023 a below-average year for the benchmark index.

Yet, as important as the Magnificent Seven may be, investors shouldn’t get tunnel vision; there are many other stocks worthy of their attention. Let’s have a look at three such names.

1. CrowdStrike Holdings

First up is CrowdStrike Holdings (NASDAQ: CRWD). CrowdStrike’s stock is one of the top-performing Nasdaq-100 names so far this year, having registered a 12% gain as of this writing. The stock is also up almost 180% over the last 12 months.

And why has the stock been on fire? In short, it’s down to the old rules of supply and demand. CrowdStrike is one of the world’s leading cybersecurity companies. Through the use of artificial intelligence (AI), the company provides its customers with cloud-based security modules that protect networks, data, and endpoints.

The need for this protection is increasing. Organizations are desperate to secure their digital assets due to the rapid rise in cyberattacks, ransomware, and data breaches.

In light of this situation, CrowdStrike’s customer base is exploding, and its revenue is skyrocketing. As of its most recent quarter (the three months ended on Oct. 31, 2023), CrowdStrike reported revenue of $786 million, up 35% from a year earlier. Moreover, $733 million of that revenue — some 93% — was subscription-based.

Those improving fundamentals are driving CrowdStrike’s stock back toward its all-time high. Growth-oriented investors should take note that CrowdStrike remains primed to cash in on the rapid growth of the cybersecurity market.

2. Arista Networks

Next is Arista Networks (NYSE: ANET). The company, which provides networking solution tools, is an under-the-radar AI play, given the importance of networking resources to the advancement of AI.

As the company notes in a recently published white paper available on its website, “As AI continues to advance at unprecedented pace, networks need to adapt to the colossal growth in traffic transiting hundreds and thousands of processors with trillions of transactions and gigabits of throughput.”

To put it another way, as data centers and supercomputers grow larger and more complex to handle more advanced AI, the networks connecting the underlying processors will also need to improve. Fast AI requires fast networks, and Arista is one of the leaders in optimizing networks.

Turning to finances, Arista Networks’ key metrics are soaring. In one year, the company’s free cash flow per share has increased from $1.42 to $4.77 — an increase of 336%. That’s hugely important, as free cash flow per share is one of the most important financial metrics for a stock.

In summary, Arista Networks is well positioned to benefit from the skyrocketing demand for AI products and systems. Moreover, its strong, improving fundamentals make it an attractive choice for growth investors willing to buy and hold.

3. Advanced Micro Devices

Finally, we come to a personal favorite: Advanced Micro Devices (NASDAQ: AMD).

In my view, there are three reasons why AMD is such an attractive stock.

First, there is the secular growth story. The growth of the Graphics Processing Unit (GPU) market is, by far, the biggest reason to be bullish on AMD. These high-powered semiconductors are the chips of choice for AI developers, thanks to their ability to quickly process data.

Now, thanks to the introduction of its MI300 series of chips, AMD is directly competing with Nvidia in this red-hot market. Indeed, in a recent conference, AMD’s Chief Executive Officer (CEO) Lisa Su estimated that the Total Addressable Market (TAM) for AI-related chips will reach $400 billion over the next four years.

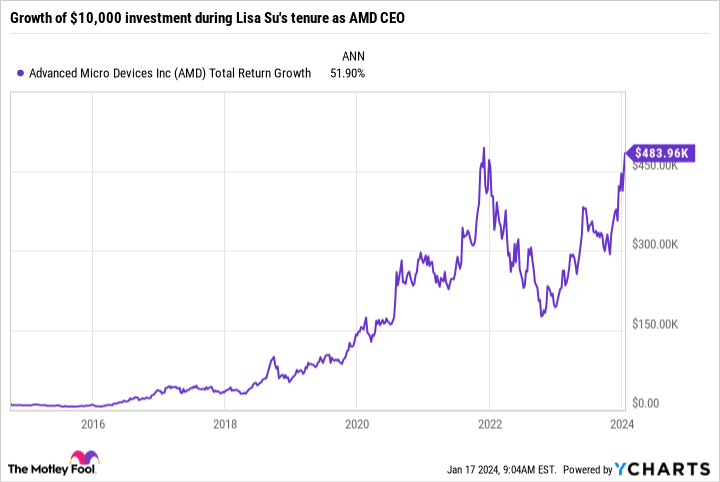

That leads to my second reason to be bullish on AMD: the company’s fantastic leadership. Starting with CEO Lisa Su, AMD’s management team has delivered incredible returns for AMD. In point of fact, AMD shares have gained an eye-popping 4,370% during Su’s time as CEO — meaning a $10,000 investment made on her start date of Oct. 8, 2014, would be worth a staggering $484,000 as of this writing.

What’s more, AMD’s key fundamentals can’t be ignored. Over the last 12 months, the company has generated $22.1 billion in revenue, nearly double the $11.4 billion it reported three years ago.

Granted, valuation will be a concern for some investors. The company’s forward price-to-earnings (P/E) ratio stands at 42 times, putting it out of reach for value investors or those otherwise uncomfortable with high-valuation stocks.

Nevertheless, long-term growth investors should give AMD a hard look. The AI revolution is here to stay, and AMD, with its excellent leadership and new AI-focused chips, is a stock with a bright future ahead of it.

Should you invest $1,000 in Advanced Micro Devices right now?

Before you buy stock in Advanced Micro Devices, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Advanced Micro Devices wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 16, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Jake Lerch has positions in Alphabet, Amazon, CrowdStrike, Nvidia, and Tesla. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Arista Networks, CrowdStrike, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool has a disclosure policy.

3 Artificial Intelligence (AI) Stocks Ripe to Be One of the Next “Magnificent Seven” was originally published by The Motley Fool

Source link