[ad_1]

Despite plenty of positive headlines, many electric vehicle companies are struggling to make vehicles at scale and survive in 2024. One of the companies in survival mode is Fisker, which announced Monday that it had reached an agreement with its debtholders to reduce debt in exchange for equity in the company. This may seem like a small victory, but it does show that investors are still willing to give companies a runway to go after a slice of the EV market.

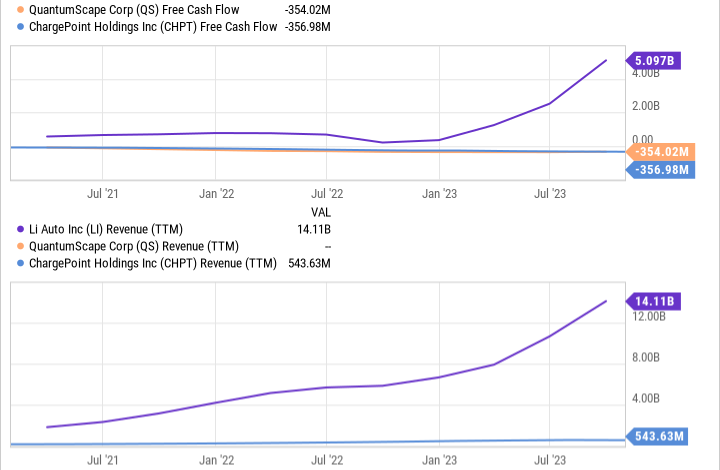

The reaction among investors in other players elsewhere in the EV sector was mixed. Li Auto (NASDAQ: LI) fell by as much as 6.4% because a competitor was propped up for the time being. But solid-state battery maker QuantumScape (NYSE: QS) jumped 7.6% and EV charging station network operator ChargePoint (NYSE: CHPT) rose 17.2% in early trading on Monday. Shares of those stocks were down 3.2%, up 3.2%, and up 9.8%, respectively, as of 2 p.m. ET.

Investors give a lifeline

Fisker got a waiver from its debtholders on financial covenants and was able to reduce $510 million in debt to $324.5 million in exchange for 159.1 million shares of stock.

This isn’t directly impacting companies like Li Auto, QuantumScape, and ChargePoint, but it speaks to how investors are thinking about the industry’s finances. Fisker hasn’t been able to scale production or get anywhere close to profitability, but investors are giving it more time rather than forcing the company into bankruptcy, which may result in even worse losses.

That may mean that money-losing companies like QuantumScape and ChargePoint will be able to find long-term financing options as well. It would also mean more EVs hitting the road, which would add to the demand for batteries and electric vehicle chargers.

Competition is getting fierce

On the flip side, Li Auto investors were counting on the company getting a reprieve in 2024 as the balance sheets of some of its competitors get stretched, so for them, Fisker’s financing news was less positive. Li has been performing well and is generating free cash flow, so I don’t think it’s in trouble, but investors are seeing less reason to be bullish about it.

What we can see is that competition is going to be fierce in electric vehicles for the foreseeable future. Upstarts aren’t giving up, and investors aren’t writing off their investments, yet.

It’s worth keeping in mind that this is just one day of trading, and the long-term trajectory of these companies is more important than any single session. QuantumScape and ChargePoint are both losing money rapidly, and QuantumScape hasn’t even started generating revenue yet.

These stocks may be up Monday, but they’re high risk for investors. That’s why I’m staying out of this market right now. It’s too uncertain to invest in the EV market today, especially given the financial losses companies are taking. 2024 is going to be a volatile year. Don’t be surprised if today’s gains turn into tomorrow’s declines.

Should you invest $1,000 in QuantumScape right now?

Before you buy stock in QuantumScape, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and QuantumScape wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 22, 2024

Travis Hoium has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Why (Most) EV Stocks Had a Phenomenal Day Today was originally published by The Motley Fool

Source link