[ad_1]

If you got sick of all the artificial intelligence (AI) talk in 2023, you should know it probably won’t lessen in 2024. With some saying AI and machine learning (ML) could be as transformational to business as the internet, it’s best to roll with it. Especially because the International Monetary Fund (IMF) believes AI will impact 40% of jobs globally.

AI/ML is an expansive area, so it may be tough to know where to start. Just a few examples of the technology include:

-

Speech recognition (great for automobiles and drive-thru kiosks)

-

Chatbots (terrific for online customer service and many other functions)

-

Cybersecurity applications

-

Virtual assistants

-

Autonomous vehicles

-

Factory robotics

-

Medical research and diagnosis

While the arena is massive, there are a few popular companies investors should know right off the bat. I’ll start right at the top with heavyweights Nvidia (NASDAQ: NVDA), Alphabet (NASDAQ: GOOG)(NASDAQ: GOOGL), and Amazon (NASDAQ: AMZN) and then up-and-comers like Palantir (NYSE: PLTR) and UiPath (NYSE: PATH).

Nvidia

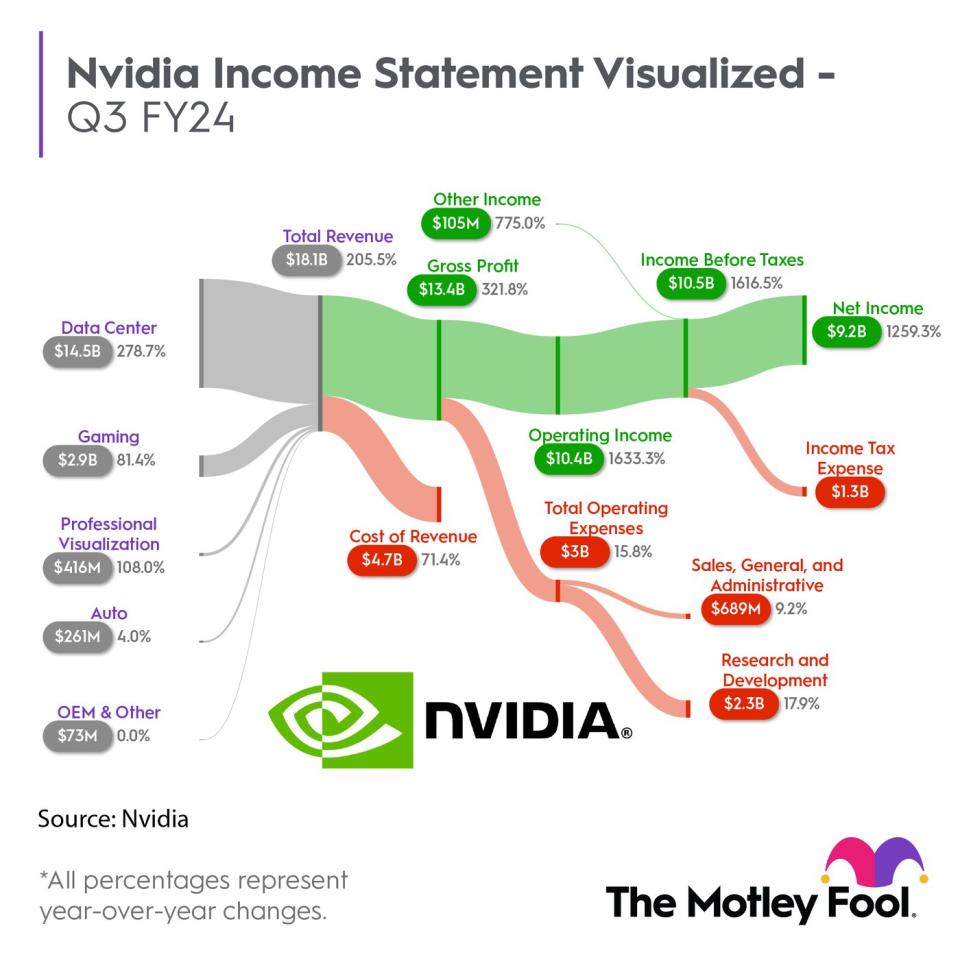

Nvidia is among the most important companies because of its high-powered, essential data center hardware and software. Without Nvidia’s graphics processing units (GPUs) and other products, AI applications would be difficult to execute. This has brought the company incredible success, which the infographic below depicts.

First, we can see that total revenue increased 205% year over year (YOY) to $18 billion in the third quarter of fiscal year 2024 on the back of data center revenue, which increased 278% to $14.5 billion — a ridiculous clip. Even more incredible, data center growth accelerated in Q3 of fiscal year 2024, eclipsing 171% in Q2.

The next major takeaway is the company’s operating income (center of the graphic). It soared 1,633% to $10.4 billion on a 57% margin. Nvidia’s profits skyrocketed because demand was higher than supply. They cannot produce enough to satisfy their customers, so they have pricing power.

Nvidia has some challenges, like U.S. restrictions on exports to China and competition working hard; however, Nvidia creates new chips that meet export requirements to China, and it has a significant head start on competitors like Advanced Micro Devices and Intel.

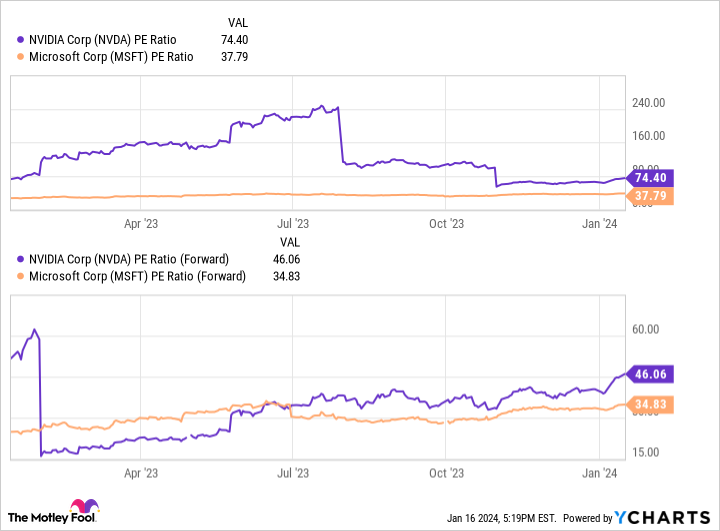

Trading at 74 times earnings, the stock isn’t cheap and likely won’t be anytime soon. This drops to 46x on a forward basis (compared to Microsoft at 35x), which is more palatable.

Wall Street has a history of underestimating Nvidia’s future earnings. Still, be cautious at the current price or consider dollar-cost averaging.

Alphabet

In late 2022, Alphabet found itself caught flat-footed when OpenAI’s ChatGPT hit the stage, and Microsoft invested billions to bring the generative AI tech to Bing. Suddenly, there was serious competition for Google Search — Alphabet’s gravy train that produced $127 billion in revenue through Q3 2023, 57% of the company’s total sales.

Luckily, Alphabet has studied AI for years and has many solutions that have come out or are coming soon. There is Bard, Alphabet’s answer to ChatGPT. Alphabet recently upgraded Bard with its Gemini tech to enhance its performance.

Google Search has new features that allow users to search with a picture, optimize translation services, and provide more relevant results. The company developed its own chip, the tensor processing unit (TPU), for generative AI applications. Perhaps the ChatGPT release was the kick in the pants Alphabet needed to get its AI program to the market.

Alphabet’s sales are up 7% YOY through Q3 2023 to $221 billion; however, growth accelerated to 11% in the last quarter. More impressively, cash from operations is up 22% this year, reaching $83 billion to show that Alphabet is still a cash-flow machine. The stock is fairly valued, trading close to its five-year average price-to-earnings (P/E) ratio of 27.

Amazon

Amazon is among the most exciting AI companies because it benefits from AI on multiple fronts. Generative AI software requires massive data processing, much of which runs through the cloud. Amazon Web Services (AWS) is the world’s largest provider of cloud services. Growth at AWS slowed in 2023 because companies cut their data usage budgets in anticipation of a recession, but AI and increased budgets could turn this around in 2024.

The company also uses AI in digital advertising and logistics, and Amazon Bedrock provides foundational models for companies to tailor AI applications to their needs.

While AWS growth slowed in 2023, areas like digital advertising thrived, and Amazon grew total revenue by 11% through Q3 2023 to $405 billion. Positive free cash flow and net income also returned after a difficult 2022.

The stock trades well below its recent averages based on operating cash flow and sales, as shown below.

The valuation and opportunity make Amazon stock an alluring buy.

Palantir

Palantir has been unapologetically hyping its AI prowess since before AI was the thing to be. The company helps governments and businesses manage, analyze, visualize, and act on data. It also provides a platform where clients can build and deploy applications, and its new Artificial Intelligence Platform (AIP) software expands on this by using AI to enhance logical decision-making.

Palantir is a critical partner in the defense industry and is making strides in the private sector. Last quarter, private sector sales increased 23% YOY to $251 million, while government sales grew 12% to $308 million. Palantir also achieved its fourth straight quarter of generally accepted accounting principles (GAAP) profits, has $3.3 billion in cash and investments, and has no long-term debt. It’s no wonder it’s a popular stock. Still, its 17% YOY growth last quarter may not justify its current valuation of 17x sales.

UiPath

UiPath is getting some well-deserved attention lately. The company is a leader in robotic process automation (RPA). RPA has many use cases that get to the heart of AI/ML: efficiency.

For instance, picture a large company that receives hundreds of invoices daily through email. Instead of manually downloading and inputting them (as is the case now), RPA does this automatically with minimal human intervention. This is why UiPath reported $1.4 billion annual recurring revenue on 24% growth and over 10,800 customers last quarter.

There is intense industry competition, namely from Microsoft, which gives investors pause. However, the company is on firm financial footing, reporting $1.75 billion in cash and investments with no long-term debt, and trades for just 10x sales. This makes UiPath a very compelling stock for growth-oriented investors.

Many terrific companies are doing innovative things in AI. Of these popular companies, I think Amazon and UiPath are the most intriguing buys based on potential and valuation; however, each name has a lot to like.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 16, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Bradley Guichard has positions in Alphabet, Amazon, Nvidia, and UiPath. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Microsoft, Nvidia, Palantir Technologies, and UiPath. The Motley Fool recommends Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, and short February 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

AI Cheat Sheet: The 5 Most Popular Stock Picks (and Why) was originally published by The Motley Fool

Source link