[ad_1]

Generative artificial intelligence (AI) has continued to drive semiconductor stocks — like MRVL, TSM, and MU — higher lately. But as valuations swell, some of the more value-conscious investors may be wondering if 2024 will see a violent end to the AI-driven “chip rip” and if it could end in tears for investors who showed up late to the game.

With Dr. Michael Burry (the genius investor behind The Big Short) betting against chip stocks, it’s become quite uneasy to bet on the broader basket of red-hot semiconductor plays at this juncture. Who would dare bet against Dr. Burry? Thus far, the bulls have been right, and Burry has been proven either wrong or early.

Indeed, being early can be just as bad as being wrong when you’re shorting securities. In any case, investors who aren’t rattled by Burry’s bearishness may wish to consider the following plays that still have Wall Street’s confidence. Therefore, let’s check in with TipRanks’ Comparison Tool to see where analysts stand on the following chip stocks.

Marvell (NASDAQ:MRVL)

Marvell stock has been hot of late, surging 70% over the past year alone. Still, it hasn’t been nearly as hot as some of its semiconductor peers. Further, shares are still well off (around 20%) their all-time highs hit at the very end of 2021. With newfound momentum behind the specialty chip maker, it seems to be just a matter of time before new highs are met, especially if generative AI demand heats up further in 2024.

All things considered, I view Marvell stock as a compelling semiconductor play that’s just as worthy (if not more so) as the broader batch. As such, I’m staying bullish on MRVL, just like the analyst community.

Marvell boasts what it says is “the industry’s most complete data infrastructure semiconductor portfolio.” With many bases covered, Marvell stands to win big if the AI trade is ready to power higher from here.

Rick Schafer of Oppenheimer touts Marvell as one of his top four AI plays. He thinks Marvell is one of the AI plays that’s a in good spot to “push to monetize their AI strategies,” I couldn’t agree more. When it comes to AI and semiconductors, there will be more winners than just the GPU makers that have continued hogging the headlines.

Despite Schafer’s enthusiasm, he sports a mere $70.00 price target (that’s slightly below the Street average). I think investors should watch Mr. Schafer hike his target as the firm continues knocking quarters out of the ballpark.

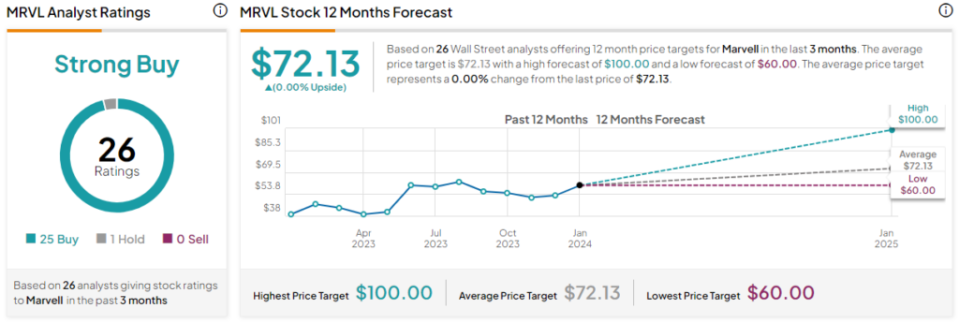

What is the Price Target for MRVL Stock?

Marvell stock is a Strong Buy, according to analysts, with 25 Buys and one Hold assigned in the past three months. Nevertheless, the average MRVL stock price target of $72.13 implies that the stock is fairly valued.

Taiwan Semiconductor (NADSAQ:TSM)

Taiwan Semiconductor makes a strong case for why it should be viewed as one of the most undervalued semiconductor companies on the planet right now. At $116 and change, shares go for a bit over 17 times forward price-to-earnings (P/E), well below the 22.75 times multiple of the semiconductor industry average.

As is typical, cheap, high-quality stocks tend to be cheap for a reason. In the case of Taiwan Semiconductor, it’s the country in which the firm is domiciled. Though the location of the firm entails a degree of geopolitical risk, I just can’t dismiss TSM as a value trap solely because of its location. As such, I’m inclined to stay bullish on the firm for 2024.

Taiwan Semiconductor may be a crown jewel in Taiwan that’s critical to the global chip world, but its high degree of geopolitical risk is difficult to fully factor into valuation models. It’s this geopolitical risk that’s put off many value investors, including the likes of Warren Buffett, who sold off his stake in the firm last year, citing “location” as something he did not like about the firm.

The recent Taiwanese general election could spark more tension with China, and if matters do spill over, Taiwan Semiconductor stock could stand to sag even as the firm continues firing on all cylinders. For now, analysts believe risks are worth bearing for exposure to one of the biggest and best companies in the semiconductor scene today.

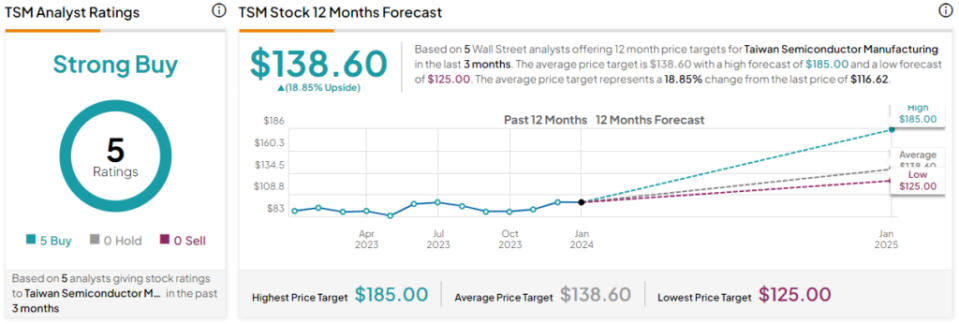

What is the Price Target for TSM Stock?

Taiwan Semiconductor stock is a Strong Buy, according to analysts, with five Buys assigned in the past three months. The average TSM stock price target of $138.60 implies 18.9% upside potential.

Micron (NASDAQ:MU)

It’s not only AI chips that will benefit as the generational AI boom moves into its next chapters. Firms running next-generation models are going to need plenty of appetite for memory, and that’s where Micron comes into play. Like Marvell and TSM, Micron stock is still down from its all-time highs, making it a potential catch-up trade for investors interested in getting in on the “chip rip.”

Just a few weeks ago, Micron stock was praised as a top chip pick at Wells Fargo (NYSE:WFC) over the likes of two GPU darlings that have continued to defy the laws of gravity. With a more modest multiple and less obvious AI upside, I also remain bullish on MU stock.

Although Micron, which creates some of the best DRAM (dynamic random access memory) and NAND memory chips, doesn’t have a front-row seat to the AI boom like the GPU makers, it does have a seat in the auditorium. And with a more modest price of admission, I’d argue there’s more upside to be had for investors looking for a more “GARP” way to play the space.

Up ahead, the company expects that AI will pave the way for record memory demand. Though management’s guidance was already recently hiked, I think there’s a good chance it could be surpassed as AI momentum continues strong.

What is the Price Target for MU Stock?

Micron stock is a Strong Buy, according to analysts, with 24 Buys, two Holds, and one Sell assigned in the past three months. The average MU stock price target of $96.57 implies 10.2% upside potential.

The Takeaway

I wouldn’t bet against the Strong Buy-rated semiconductor stocks, even if Dr. Burry is shorting them for the year. While valuations have swelled in recent months, the magnitude of the AI boom could make such a valuation-multiple expansion more than warranted. Of the trio, analysts expect the most gains from TSM stock (~18.9%) for the year ahead.

Source link