[ad_1]

A year ago, the markets were just beginning their recovery from bear times. Growth stocks started to take off, and investors wondered when we could officially call a bull market. Well, that time is now, offering us an excellent start to 2024. The S&P 500 recently hit a new record high, confirming the market is indeed in one of these much-awaited phases of optimism and growth.

In more good news, history shows us bull markets generally last longer than bear markets, offering our portfolios time to benefit. And to maximize your bull market potential, it’s a great idea to buy shares of growth stocks. That’s because they tend to excel in bull market environments and times of economic recovery and expansion. Here are my top growth stocks to buy in 2024.

1. Amazon

Amazon (NASDAQ: AMZN) is a the ideal growth stock because it’s a leader in two high-growth markets: e-commerce and cloud computing. The company also is investing heavily in the hot area of artificial intelligence (AI), which is boosting earnings in two ways.

AI is driving efficiency in Amazon’s operations, helping it to lower costs. And Amazon, through cloud computing business Amazon Web Services (AWS), offers AI tools to clients. Considering the high demand in this area, AWS’ AI tools could keep these clients coming back, boosting AWS’ revenue. This is particularly important since AWS traditionally has driven profit at Amazon.

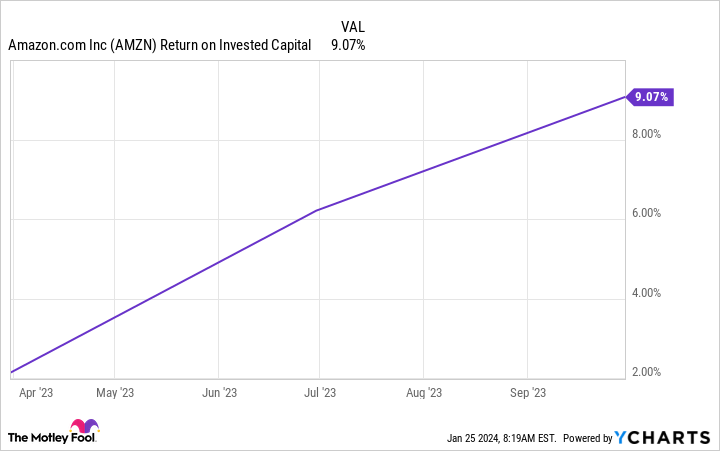

Amazon’s recent efforts to revamp its cost structure — to fight rising inflation and other challenges — have been bearing fruit. Back in 2022, the company reported its first annual loss in about a decade. But by early last year, Amazon already was reporting quarterly gains in net income, and its outflow of cash had shifted to an inflow. In the most recent quarter, the company’s net income more than tripled, and free cash flow improved to an inflow of more than $21 billion. Return on invested capital also has been on the rise over the past year.

These moves should benefit the company in better times, too. Amazon improved efficiency across its fulfillment network, for example switching to a regional model from a national model in the U.S. The shorter delivery distances are driving improvements in Amazon’s “cost to serve,” and the company sees potential for ongoing progress here.

So, even though Amazon stock climbed last year, the potential for gains is far from over — and the stock could be one to excel in this bull market.

2. Carnival

Carnival (NYSE: CCL) had a difficult time of it earlier in the pandemic when sailings were halted, but the world’s biggest cruise operator has since roared back to growth. Demand for cruise vacations soared, as we can see in Carnival’s revenue and bookings. In the most recent quarter — the fiscal fourth quarter — Carnival reported record revenue, and bookings in the two weeks around Black Friday hit an all-time high for that period.

For the fiscal year that ended in November, Carnival reported record revenue of more than $21 billion and entered the new year with its best booked position ever, taking into account occupancy and price. And this has helped the company make gains in earnings, for example, reporting a narrower-than-expected U.S. GAAP net loss of $74 million for the year and positive adjusted net income of $1 million.

Investors’ biggest concern about Carnival has been the company’s debt levels. While ships were docked during early pandemic days, Carnival built up a wall of debt just to stay afloat (excuse the pun). But Carnival has made significant progress here, too, cutting debt by $4.6 billion from its peak, and Carnival says ongoing growth in adjusted free cash flow will help it pay down more debt over time.

Carnival’s booking volumes and customer deposits, which also have reached records, are reason to be optimistic about earnings. And the company’s other efforts to streamline operations and cut fuel costs add to earnings growth potential.

That’s why now, as Carnival charges ahead in its recovery and growth story, is the perfect time to pick up this stock.

3. Apple

Apple (NASDAQ: AAPL) is a market giant thanks to leading products like the iPhone and Mac computers, but that doesn’t mean the company has reached a plateau when it comes to growth. In fact, three things are set to drive earnings growth well into the future.

The first is Apple’s brand strength, which helps keep Apple users coming back to buy the latest iPhone or Apple Watch instead of trying a rival product. This brand strength is part of Apple’s moat, or competitive advantage — a key element that could keep this company ahead over time.

The second growth driver is Apple’s services business, which in the most recent quarter reported record revenue. This is because all of those loyal Apple fans also subscribe to certain services through their devices — from digital content to cloud storage. The enormous user base Apple has built over the years (the installed base of active devices topped 2 billion) now represents a source of recurrent revenue.

And, importantly, gross margins on services are higher than those on products — 70% compared with 36% in the most recent quarter.

Finally, Apple still continues to gain new customers, so it hasn’t yet reached a maximum when it comes to gaining market share. In the quarter, half of Mac and iPad buyers were new to those products.

Considering all of this, Apple’s growth story is set to be a long one, and the new bull market may be one of the most exciting chapters — for the company and for shareholders.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 22, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adria Cimino has positions in Amazon. The Motley Fool has positions in and recommends Amazon and Apple. The Motley Fool recommends Carnival Corp. The Motley Fool has a disclosure policy.

My Top Bull Market Growth Stocks to Buy in 2024 was originally published by The Motley Fool

Source link