[ad_1]

It seems like everyone and their uncle hate Intel (NASDAQ:INTC) today. This is a sign of how fickle the market can be, but I encourage you to look at the big picture and make your own decisions. When the dust settles in a while, I expect the market to appreciate Intel again, and for the long term, I am bullish on INTC stock.

Intel is a chipmaker that, unlike some of the company’s competitors, actually manufactures its own microchips. Having a foundry business is risky, no doubt, but it’s what sets Intel apart.

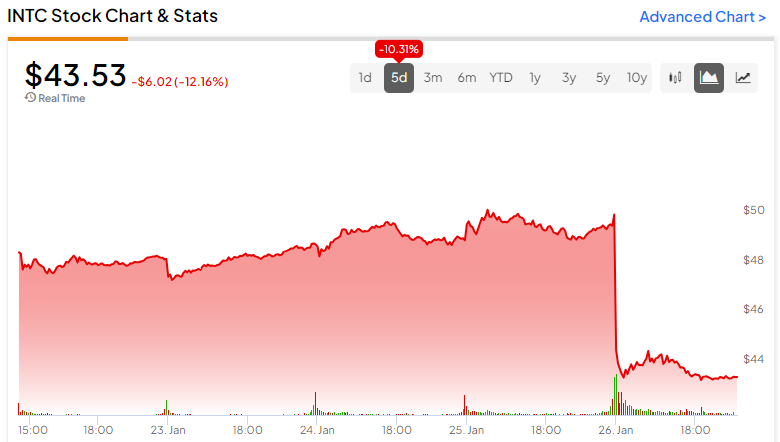

Today’s INTC stock dumpage is a textbook example of how investor sentiment can turn on a dime. In just a year’s time, Intel has gone from doghouse to darling and back. Don’t be frustrated at the market’s wild mood swings, though, since irrational behavior leads to volatility, and volatility leads to opportunity.

The Good News That No One is Talking About

INTC stock is down 12% today, even though there are multiple positive news items to report. In effect, the market is so hyper-focused on Intel’s quarterly report and forward guidance that it’s completely overlooking some important developments concerning Intel.

First of all, Intel just celebrated the opening of the company’s factory in Rio Rancho, New Mexico. According to Keyvan Esfarjani, Intel executive vice president and chief global operations officer, this represents the “opening of Intel’s first high-volume semiconductor operations and the only U.S. factory producing the world’s most advanced packaging solutions at scale.”

Furthermore, Intel announced a collaboration with Taiwan-based United Microelectronics Corporation (NYSE:UMC) to develop a “12-nanometer semiconductor process platform to address high-growth markets such as mobile, communication infrastructure and networking.” It’s interesting that Intel is partnering with a Taiwanese foundry business like United Microelectronics Corporation.

With this Taiwan-based partnership, could Intel and UMC be poised to steal significant market share from Taiwan Semiconductor (NYSE:TSM)? It’s a question that ought to be considered, but hardly anyone’s thinking about it today.

The Market Can’t Tolerate Cautious Guidance

To be blunt, the market is so spoiled that it won’t tolerate anything but a full-on beat-and-raise anymore. Sometimes, there’s a beat-and-raise, but the earnings beat and/or the guidance raise isn’t high enough to impress investors. It’s a strange phenomenon – but again, irrationality leads to opportunity.

With its results for the fourth quarter of Fiscal Year 2023, Intel definitely achieved the “beat” part of the beat-and-raise formula. Intel CEO Pat Gelsinger had every right to boast, saying, “We delivered strong Q4 results, surpassing expectations for the fourth consecutive quarter with revenue at the higher end of our guidance.”

Here’s the rundown. Intel’s quarterly revenue grew by 10% year-over-year to $15.4 billion, beating analysts’ consensus expectations by $230 million. Moreover, Wall Street called for Intel to post Fiscal Q4-2023 earnings of $0.45 per share, but the company actually earned $0.54 per share.

After INTC doubled from $24 and change to $50, you might assume that Intel’s Street-beating quarterly results would send the share price higher. Yet, Intel didn’t deliver the “raise” part of the beat-and-raise combo that people expect nowadays.

Specifically, Intel provided a current-quarter revenue guidance range of $12.2 billion to $13.2 billion, while analysts’ consensus forecast called for $14.2 billion in revenue. In addition, whereas Wall Street forecast adjusted Fiscal Q1-2024 earnings of $0.32 per share, Intel’s management only guided for $0.13 per share.

In light of this, a number of analysts have turned cautious on INTC stock. Two examples are Bernstein’s Stacy Rasgon and Stifel Nicolaus’s Ruben Roy, who recently published Hold/Neutral ratings on Intel shares. Furthermore, Rasgon’s $42 price target and Roy’s $45 price target aren’t particularly optimistic.

Think about it – Intel stock would have to go practically nowhere for the next 12 months in order to land at those price targets. Yet, the company’s results demonstrate that Intel is capable of surpassing Wall Street’s financial estimates. Now that the current-quarter expectations are quite low, don’t be too surprised if there’s another earnings beat coming — though I can’t guarantee a beat-and-raise, which everybody seems to demand now.

Is Intel Stock a Buy, According to Analysts?

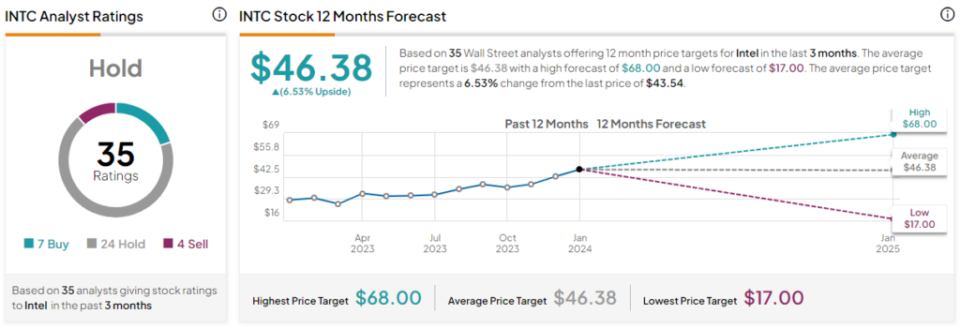

On TipRanks, INTC comes in as a Hold based on seven Buys, 24 Holds, and four Sell ratings assigned by analysts in the past three months. The average Intel stock price target is $46.38, implying 6.5% upside potential.

Conclusion: Should You Consider Intel Stock?

Intel set the bar low for the current quarter. Investors reacted badly to this, but that’s how opportunities arise. All of this could just be a setup for another earnings beat and more optimistic guidance in a few months.

It’s difficult to envision a good outcome when the market’s sentiment is so negative about Intel. Bear in mind, though, that investors favored Intel just a few days ago. They’ll come to appreciate Intel again, I predict, so I feel that it’s smart to consider INTC stock while it’s trading at a reduced price.

Source link