Market prophet Gary Shilling expects S&P 500 returns to slump — and warns a recession could stretch into 2025

[ad_1]

-

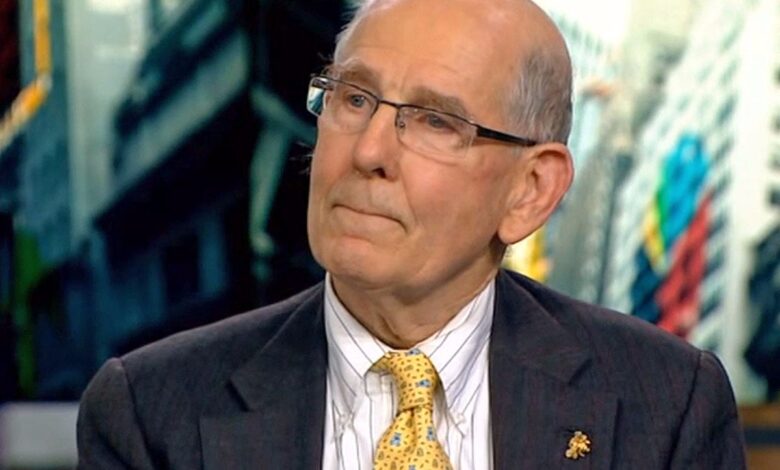

Investors should expect lower stock market returns in the future, Gary Shilling says.

-

The legendary forecaster cited slower economic growth, steep valuations, and fading speculation.

-

Merrill Lynch’s first chief economist said a recession appears likely and could extend into 2025.

Investors in the stock market face decades of disappointment, and a recession threatens to strike this year and extend into 2025, a legendary market forecaster warned.

The S&P 500 has gained an average of 12.3% a year including dividends since bottoming in July 1982, but it’s likely to post lower returns going forward, Gary Shilling wrote in his Insight newsletter for February.

Merrill Lynch’s first chief economist, who launched his own consultancy and advisory firm in 1978, is known for correctly calling several major market shifts over the past 50 years.

In his latest outlook, Shilling predicted stocks would be held back by slower real economic growth, reflecting modest labor-force and productivity gains and an ageing population that saves more and spends less. The president of A. Gary Shilling & Company also suggested that slower inflation would weigh on nominal increases in stock prices.

Moreover, Shilling underscored that equities are aggressively valued relative to corporate profits, with the S&P 500’s price-to-earnings ratio for the last 12 months at 24.8 — well above the long-term average of 17.3. He also called out recklessness and silliness in markets, and predicted that would dissipate over time.

“A key reason that stock prices are elevated and likely to be subdued in future years is the demise of widespread speculation,” he said. “Despite the collapse of FTX and accusations of fraud by its founder and head, Sam Bankman-Fried, many continue to rush into securities with little or no substance.”

Shilling accused bitcoin and other cryptocurrencies of distracting investors and sapping productivity. He said the post-pandemic drop in the CBOE Volatility Index, Wall Street’s “fear index,” signaled “investor complacency and a switch from fear to greed, as do elevated stock prices.”

He also flagged the declining ratio of bearish put options to bullish call options, analysts’ lofty earnings forecasts, and the intense concentration of investor cash in the “Magnificent Seven” stocks as evidence of excessive optimism and trouble ahead.

On the economic front, Shilling made the case that labor hoarding has delayed pay cuts and layoffs, as employers are loath to let go of workers after struggling to hire in recent years: “As a result, the overall economic softness — or, more likely, a recession — may well stretch into next year.”

It’s worth noting that Shilling warned several times in recent months that the S&P 500 could crash by 30% or more, and a recession was nigh if not already underway. However, the benchmark stock index has surged to record highs, and the US economy grew by a solid 3.3% in the fourth quarter.

Read the original article on Business Insider

Source link