[ad_1]

Excitement around artificial intelligence (AI) dominated the tech sector last year. In particular, megacap enterprises such as the “Magnificent Seven” produced outsize gains and helped push the Nasdaq Composite over 40%. Indeed, AI tailwinds seem to have carried over into 2024 and are one of the core reasons the S&P 500 is trading at record high levels.

Underneath the AI umbrella, one of the biggest themes surrounding the technology is semiconductors. In particular, Nvidia‘s leading position among chip manufacturers helped fuel the stock over 200% last year.

However, savvy investors understand that there are other opportunities alongside semiconductor businesses. With a market cap of just $28 billion, Super Micro Computer (NASDAQ: SMCI) may not be on your radar yet. The company designs server and storage solutions and notably leverages Nvidia’s and Advanced Micro Devices‘ GPU systems.

As investors continue to pour into semiconductor stocks, a thorough analysis of Super Micro’s business may shed light on tangential opportunities in the space.

What does Super Micro actually do?

Super Micro manufactures IT architecture such as server rack solutions and storage clusters. As applications for generative AI continue to grow, demand for high end compute and storage solutions should also rise.

On the surface, this trend seems to be beneficial for chip businesses. However, companies like Super Micro are also a beneficiary given their role in design solutions. This is why George Tsilis of TD Ameritrade referred to Super Micro as a “stealth Nvidia” opportunity. While the company does not directly compete with chip makers, its relationship with the industry’s leading players has served as a bellwether for business.

How is Supermicro performing?

Over the last year, Super Micro has witnessed more pronounced growth as demand for AI solutions increased. In fact, in mid-January the company revised guidance for its second quarter of fiscal 2024, ended Dec. 31.

Initially, management guided for sales between $2.7 billion and $2.9 billion for the quarter and earnings per share (EPS) between $3.75 and $4.24. However, the company’s new guidance called for revenue of $3.6 billion and earnings of nearly $5 per share.

Jus this week Super Micro reported results for its second fiscal quarter, exceeding its own expectations. The company reported revenue of $3.7 billion, representing 103% growth year over year and 73% growth quarter over quarter. On the profitability side, EPS grew 62% annually to $5.10.

While the financial profile is impressive and the company’s growth prospects appear robust, a close analysis of Super Micro’s valuation would be prudent before pouring into the stock.

Should you invest in Supermicro stock?

In a way, Super Micro trades in tandem with its chip manufacturing cohorts. In other words, when Nvidia, AMD, and others tout the song of AI, Super Micro stock enjoys some increased buying activity as well. While this can make some sense, investors should realize that Super Micro stock is up almost 600% since January 2023. Moreover, a closer look at some valuation multiples below may shed some light on the company’s position relative to its actual competition.

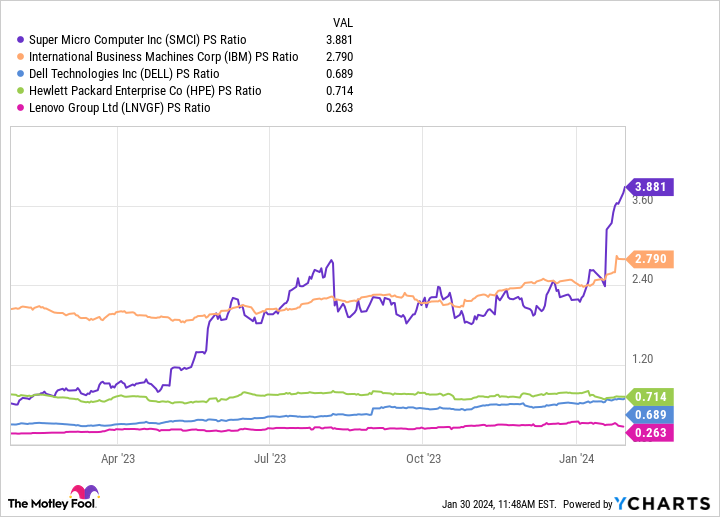

Super Micro competes with other integrated systems providers such as IBM, Hewlett Packard Enterprise, Dell, and Lenovo. At a price-to-sales (P/S) ratio of 3.9, Super Micro stock is the most expensive among its cohorts based on this metric — and it’s not even close. Furthermore, the chart above clearly illustrates the more pronounced uptick in its P/S multiple since the start of the year.

Super Micro could represent a unique opportunity for investors looking to diversify their AI holdings. However, while the stock’s premium valuation seems warranted, it could also be argued that it is overbought right now. Investors should keep in mind that Super Micro’s competitors are diversified businesses with strong capital positions. So even though the company has done a respectable job navigating the competitive landscape, it is still a relatively nascent business operating among much larger tech behemoths.

Given Super Micro’s stellar growth and its close ties to leading chip manufacturers, I am bullish on its long-term prospects but would caution investors from potentially getting caught up in a momentum play. Moreover, should Super Micro continue to differentiate among its larger competitors, the company may be worth a position for your portfolio. For now, the most prudent action may be to keep an eye on the company’s updates and its ability to execute on its growth forecasts.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 22, 2024

Adam Spatacco has positions in Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool recommends International Business Machines and Super Micro Computer. The Motley Fool has a disclosure policy.

Here Is 1 Artificial Intelligence (AI) Stock I Have My Eyes On in 2024. Hint: It’s Not Nvidia or AMD. was originally published by The Motley Fool

Source link