[ad_1]

In 2023, the major story wasn’t recession or inflation; it was the buildup of artificial intelligence (AI) and big tech stocks. It spawned the idea of the “Magnificent Seven,” a group of mega-cap tech stocks that includes Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. These stocks have rallied an average of 125% since the beginning of 2023. Nvidia leads the way with a 322% gain, but others look overvalued. For example, Microsoft trades with a price-to-earnings (P/E) ratio of 39 compared to its five-year and 10-year average of 31. Savvy investors are looking elsewhere for the next big gainers in AI, and there are plenty of compelling options. Here are three to consider.

UiPath: A leader in robotic process automation

Imagine how much your productivity would increase if you could automate your most tedious, time-consuming office tasks. Now imagine how much a whole company’s productivity would leap by having employees focused on value-added, higher-level business. This is what robotic process automation (RPA) with UiPath (NYSE: PATH) is all about.

For example, in one UiPath case study, a large manufacturer with thousands of vendors submitting tens of thousands of invoices was able to cut processing time from 7-10 days, to just one day. Meanwhile, the growing company handled a volume increase of 150% with a staff increase of just 5%. The profitability ramifications for the company are apparent and staggering; it’s likely UiPath’s products will be in demand.

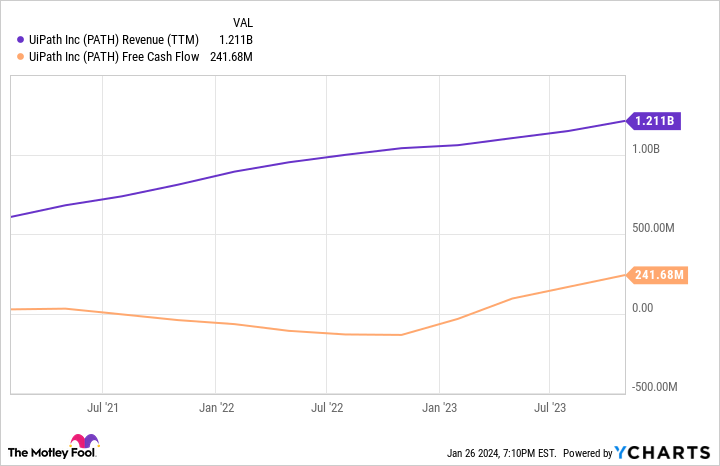

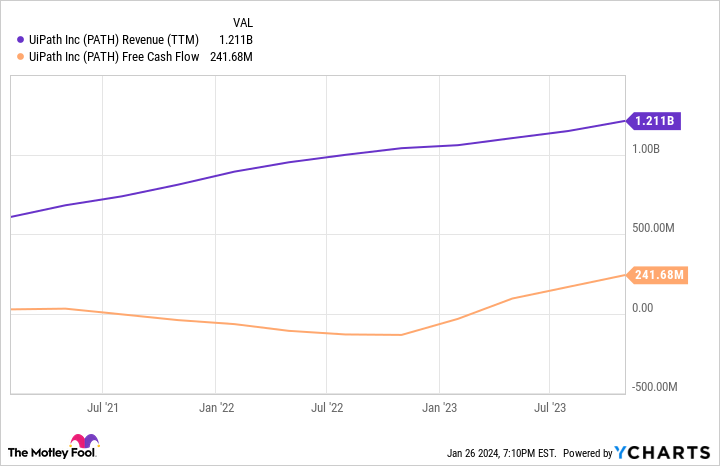

UiPath has more than 10,000 customers, $1.4 billion in annual recurring revenue (ARR), and a strong balance sheet featuring $1.8 billion in cash and investments and no long-term debt. Revenue has doubled since the beginning of 2021, and UiPath is free-cash-flow positive, as shown below.

The company is not profitable yet, which is typical of a small, growing tech business. The most significant risk to UiPath is stiff competition, including from deep-pocketed names like Microsoft. The stock trades for 10.5x sales, a competitive price compared to many other AI names, such as Palantir Technologies (NYSE: PLTR) at 17x sales. Demand for RPA will soar as businesses drive productivity, so UiPath should be on the radar of AI-oriented investors.

Palantir: A star in data analytics

Speaking of Palantir, few companies boast more AI prowess than it does. Palantir’s platforms can manage massive amounts of data and produce actionable conclusions. And if there is anything major companies (and governments) have more of today than ever, it’s data. The problem is that many don’t have the expertise to manage, visualize, and use it effectively. Palantir’s Foundry and Gotham platforms are built for this.

Palantir introduced its new Advanced Intelligence Platform (AIP) in April 2023 for businesses and defense departments. This platform leverages large language models (this is what powers generative AI like ChatGPT) for real-world, and sometimes life or death, decisions. For instance, Palantir’s defense demo shows AI using actual visual imagery of enemy combatants and produces likely enemy formations. It doesn’t get much more serious or valuable than that.

Palantir produced $2.1 billion in revenue over the trailing 12 months through the third quarter of 2023 on 16% growth. Here are two significant positives: First, Palantir receives the majority of its revenue from governments. This is optimal because defense departments have deep pockets and consistent needs. Second, its commercial sales, which allow for much more total opportunity, grew 33% year over year last quarter, outpacing government growth of 10%. This gives Palantir the best of both worlds.

As mentioned above, Palantir stock is more expensive than UiPath on a price-to-sales (P/S) basis; however, Palantir is profitable on a generally accepted accounting principles (GAAP) basis and has been for the last four consecutive quarters. It also has an incredibly strong balance sheet with $3.3 billion in cash and investments and no long-term debt. Every AI investor should know Palantir, and many should consider a position in the stock.

Accenture: A consultant to the stars

While only some of us are old enough to remember Blockbuster and Borders, business management students have studied them, and almost everyone has probably heard the cautionary tale. The two major companies went belly-up because they failed to see the changing landscape. And yes, it is 100% true: Blockbuster could have bought Netflix for $50 million but didn’t see the value in it (the company is worth $246 billion today). And that little online bookstore, Amazon, was the end of Borders. Other companies have learned the lessons of the internet transformation, and they look to consultants like Accenture (NYSE: ACN) to ensure they don’t meet the same fate.

Accenture helps companies integrate technology, design products, improve operations, and develop sound strategies. This definitely includes integrating AI and data analytics. Plus, Accenture already works with many of the Magnificent Seven — like Amazon, which it collaborates with to expedite generative AI technology adoption.

Accenture is different from the high-growth names above; it is a mature company, highly profitable, and even pays a dividend yielding 1.3%. The company earned $16 billion in revenue last quarter (its first quarter of fiscal 2024) and $2.6 billion in operating income. Its current P/E ratio of 34 is higher than the five-year average of 29. However, Accenture expects its earnings per share to rise 6% to 9% this fiscal year, and it could capitalize on the AI wave for years. Accenture is a terrific company for investors who prefer proven commodities.

The Magnificent Seven did incredibly well in 2023, but some may be too hot to handle now. Consider these lesser-known names also making waves in AI for 2024.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 29, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Bradley Guichard has positions in Alphabet, Amazon, Nvidia, and UiPath. The Motley Fool has positions in and recommends Accenture Plc, Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Netflix, Nvidia, Palantir Technologies, Tesla, and UiPath. The Motley Fool recommends the following options: long January 2025 $290 calls on Accenture Plc and short January 2025 $310 calls on Accenture Plc. The Motley Fool has a disclosure policy.

Move Over “Magnificent Seven:” 3 AI Stocks That Could Outperform in 2024 was originally published by The Motley Fool

Source link