1 Quote You Must Hear From This Artificial Intelligence (AI) Juggernaut That Makes the Stock a Screaming Buy

[ad_1]

At the heart of the artificial intelligence (AI) arms race is Taiwan Semiconductor Manufacturing Company (NYSE: TSM), also known as TSMC. It doesn’t matter which company’s graphics processing units are used to process AI data; they’re almost guaranteed to be powered by a TSMC chip, especially if they’re from AMD or Nvidia.

Even though AI has been a huge theme in the stock market over the past year, it’s just getting started. If you’re curious about how much AI will impact a chip company like Taiwan Semiconductor, you must check out this quote from management.

Taiwan Semiconductor is slated to have a strong few years thanks to AI

Taiwan Semiconductor makes the world’s best chips. It has left competitors like Intel in the dust and has continuously launched cutting-edge chips, like the 3 nanometer (nm) chip that now makes up 15% of TSMC’s revenue, despite contributing $0 in 2022. But 3 nm chips aren’t the pinnacle for Taiwan Semiconductor, as it’s already working on the next smaller iteration, 2 nm chips, which are expected to be launched in 2025.

With Taiwan Semiconductor continuously innovating, it creates a new revenue escalator every couple of years with new technology that is more powerful and efficient. This is just one of the flywheels that help Taiwan Semiconductor consistently grow.

Another is AI computing. While CEO C.C. Wei admits that its semiconductors’ value in the total data center system is a “very small percentage,” he said the compound annual growth rate (CAGR) for revenue of chips in AI systems is about 50%, which will help AI to take a high-teens percentage of its business by 2027.

That’s massive news for shareholders of TSMC, as well as GPU makers like Nvidia and server builders like Super Micro Computer.

But all of this feeds into the comment I was most excited to see in the conference call:

“Despite a challenging 2023, our revenue remains well on track to grow between 15% and 20% CAGR over the next several years in U.S. dollar terms, which is the target we communicated back in January 2022 investor conference.”

CAGR revenue growth of 15% to 20% is amazing, especially for a company the size of TSMC. That level of growth transmits to huge earnings growth, which powers stock returns over the long term.

With management reiterating its guidance, it only reinforces how much of a strong buy TSMC stock is right now.

The stock is valued below an average S&P 500 company

As mentioned above, 2023 wasn’t the greatest year for TSMC, and Q4 wasn’t the best quarter. Revenue was basically flat, and earnings per share fell. But compared to Q3 figures, revenue increased about 14% year over year.

This shows that the chip market is recovering, and 2024 could be an excellent year.

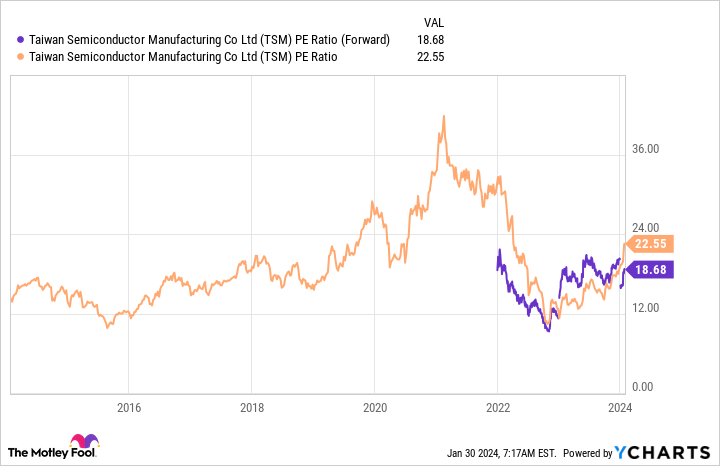

For this reason, I’ll use the forward price-to-earnings (P/E) ratio to value the stock.

At 19 times forward earnings, TSMC is actually cheaper than the S&P 500 (20 times forward earnings), according to FactSet. With TSMC having a brighter outlook than the average constituent of the index, this looks like a clear-cut case of a stock being undervalued.

If you combine that analysis with the trailing P/E that has seldom been this low over the past five years, you have a recipe for a stock that could have a phenomenal 2024 but hasn’t had a massive stock movement.

This makes Taiwan Semiconductor one of the best stocks to buy now, and investors should be willing to hold it for at least three to five years due to the strong growth management is forecasting.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 29, 2024

Keithen Drury has positions in Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Advanced Micro Devices, FactSet Research Systems, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and Super Micro Computer and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, and short February 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

1 Quote You Must Hear From This Artificial Intelligence (AI) Juggernaut That Makes the Stock a Screaming Buy was originally published by The Motley Fool

Source link