[ad_1]

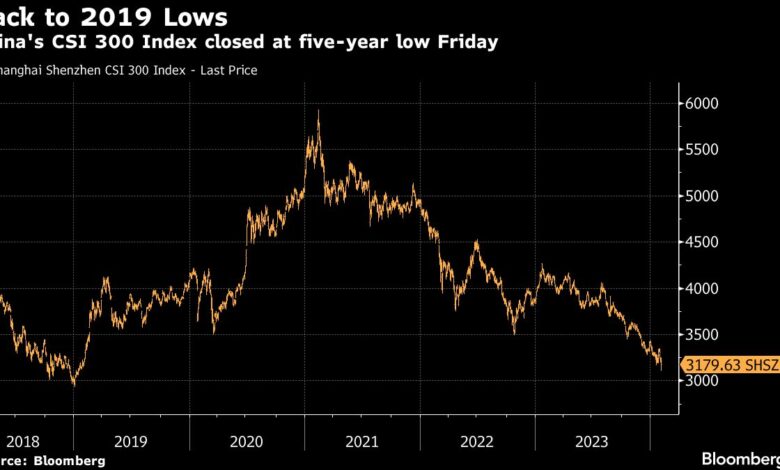

(Bloomberg) — China pledged to stabilize markets after shares sank to a five-year low in chaotic trading on Friday, but policymakers offered no specifics on how they plan to end a selloff that’s erased more than $6 trillion of value and dented confidence in the world’s second-largest economy.

Most Read from Bloomberg

The China Securities Regulatory Commission vowed on Sunday to prevent abnormal fluctuations, saying it would guide more medium- and long-term funds into the market and crack down on illegal activities including malicious short selling and insider trading.

The brief statement followed a sudden plunge of as much as 3.4% in the benchmark CSI 300 Index on Friday — and an outpouring of frustration on social media from individual investors just days before families across the country gather to celebrate the Lunar New Year.

“The statement sought to stabilize investor sentiment, but didn’t touch on fundamental problems including a lack of confidence and huge economic uncertainty,” said Shen Meng, director at investment bank Chanson & Co. “Those issues are the causes of abnormal market fluctuation.”

While authorities have taken piecemeal steps to support the economy and markets in recent months and have discussed a potential stock stabilization fund, they’ve yet to announce any major moves to stop the selloff. Weak economic data, simmering geopolitical tensions with the US, a worsening property crisis and an opaque crackdown on the financial sector have all weighed on investor sentiment.

The CSI 300 tumbled 6.3% in January, a record sixth straight month of losses. Shares rallied briefly toward the end of the month after Bloomberg reported that authorities were seeking to mobilize about 2 trillion yuan ($278 billion) for a stabilization fund, but the market has since renewed its decline, reaching the lowest level since January 2019.

Authorities should set up a stabilization fund as soon as possible to boost market confidence, with an aim to get its size to 10 trillion yuan or more, the 21st Century Business Herald daily newspaper reported over the weekend, citing Liu Yuhui of the Chinese Academy of Social Sciences, a government think tank.

In a sign of how exasperated some investors have become, thousands flocked to a social media account of the US embassy in Beijing to vent their frustrations over the economy and slumping share prices.

In the comment section of the embassy’s Weibo post on giraffe protection on Friday evening, some 53,000 users added remarks by Saturday evening, winning over 300,000 likes. China’s internet users often struggle to find a venue to air grievances about the economy or government performance, with official accounts of Chinese state agencies or media usually either disabling the comment function or only showing selected feedback.

No comments were displayed under a Friday Weibo post by the CSRC about a State Council meeting on improving the business environment.

–With assistance from Zhu Lin.

(Adds investor comment in fourth paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Source link