[ad_1]

(Bloomberg) — The most important question facing the economy and financial markets next year is not whether the Federal Reserve will cut interest rates. It’s why.

Most Read from Bloomberg

With inflation having fallen dramatically from multi-decade highs last year, rate reductions in 2024 look increasingly likely. After holding policy steady for the third straight meeting this week, Fed Chair Jerome Powell and his colleagues are expected to use their “dot-plot” to forecast rate cuts in 2024 – though probably not nearly as many as investors and economists are expecting.

If the central bank is bringing rates down in tandem with cooling inflation, that’s good news for the economy and for investors. It will mean the Fed is on the cusp of achieving an elusive soft landing in which inflation falls back toward pre-pandemic levels without the economy suffering a downturn.

But if the Fed is reducing rates because the economy is deteriorating dramatically, at risk of or in a recession, that’s a different story. That would signal that unemployment is headed markedly higher and that corporate profits would take a hit as demand decays.

“You want rate cuts because the economy has cooled and inflation has cooled, not because the economy is in recession,” said Diane Swonk, chief economist at KPMG LLP.

The motivation for Fed rate cuts has implications for how many there will be. If the economy is in or in danger of recession, officials will likely ease policy rapidly and by a lot, economists said. Smaller, slower cuts are probable if there’s no deep downturn.

President Joe Biden has a lot at stake in how Chair Jerome Powell manages the policy pivot. With voters already sour on Biden’s handling of the economy due to a surge in the cost of living, the president would face a bigger headwind to winning another term in November if the US tumbled into a recession.

There was scant sign of a contraction on the horizon in the November jobs report released Friday. Unemployment dropped to 3.7% from October’s 3.9%. Payroll gains remained solid.

Read More: Fed Rate-Cut Exuberance Ebbs After Jobs Data, Boosting US Yields

Money market traders scaled back their estimates of rate cuts following the stronger-than-forecast jobs data. They now see less than a 50% chance that the first rate cut will come in March and are betting the Fed will reduce rates by slightly more than a percentage point during 2024. Earlier this month traders had seen about a 60% chance of easing starting in March and penciled in around five quarter-point cuts for all of 2024.

The current market pricing is now more in line with economists’ forecasts. Fed watchers surveyed by Bloomberg last week expect the central bank to lower rates by 100 basis points next year, with the first quarter-point reduction occurring in June.

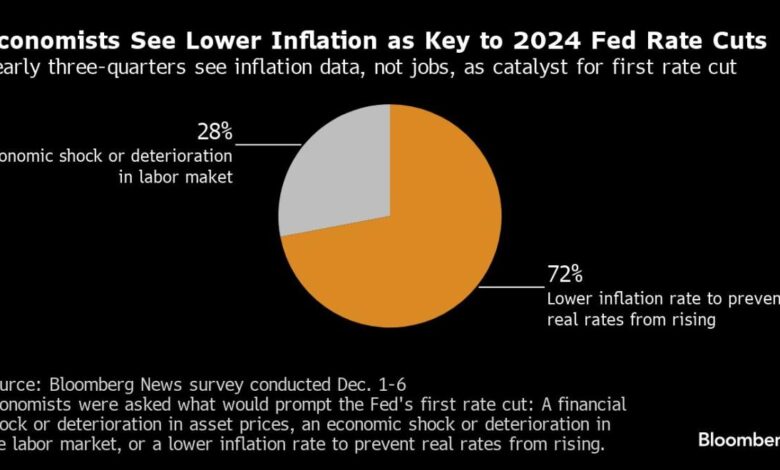

More than two-thirds of the economists polled expect the economy to avoid a recession in 2024 and close to three-quarters say the initial rate cut will come in response to ebbing inflation, not due to a contraction in the economy.

The inflation-wary central bank will be much more conservative in forecasting rate cuts than the markets when it releases its summary of economic projections this week, the survey suggested. Powell & Co. are expected to pencil in just a half percentage point of rate reductions next year in the dot plot released after their meeting, according to the Dec. 1-6 survey of 49 economists.

“We expect the dot plot to avoid suggesting cuts in the first half,” said Brett Ryan, a senior US economist at Deutsche Bank.

What Bloomberg Intelligence Says…

“Rate markets priced for deep cuts in early 2024 may get a shock next week if the Federal Reserve reiterates that it will keep interest rates at their peak well into next year.”

— Ira F. Jersey and Will Hoffman, BI strategists

For the full note, click here.

Powell told students at Atlanta’s Spelman College on Dec. 1 that it would be “premature” to speculate on when the Fed might ease policy and even left open the option that it would raise rates further if needed to bring inflation to heel.

Read More: Powell Pushes Back on Rate-Cut Bets But Markets Push Back Harder

Over the Fed’s last five credit-tightening cycles, the average time from the last rate increase to the first reduction was eight months, according to Joseph Lavorgna, chief economist at SMBC Nikko Securities America. With the Fed last having raised rates in July, that puts a March rate cut in play.

“A March rate cut is still quite likely with three more employment reports between now and then,” Lavorgna said, with a deteriorating labor market and softening inflation prompting the Fed to act.

The presidential election in November also tilts at the margin to the Fed moving earlier in the year to try to avoid the political glare, said Lavorgna, who served in the White House under former President Donald Trump.

Lavorgna sees the central bank cutting rates by 125 basis points next year, with the distinct possibility of more. That won’t be enough to forestall a recession but it will limit the damage, he added.

In contrast, Bank of America Chief US Economist Michael Gapen expects the economy to avoid a downturn and the Fed to cut rates by three-quarters of a percentage point in 2024, with the first move coming in June. The decision to reduce rates will come in response to ebbing price pressures, not a contracting economy, he said.

“There are a number of headwinds and uncertainty in the pathway for inflation,” said Lindsey Piegza, chief economist for Stifel Financial Corp. “The Fed can’t take its foot off the brake quite yet.”

–With assistance from Sarina Yoo and Liz Capo McCormick.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.

Source link