[ad_1]

(Bloomberg) — The HTX exchange, a digital-asset trading platform linked to China-born industry mogul Justin Sun, has suffered a $258 million net outflow since resuming operations after suffering a major hack.

Most Read from Bloomberg

The funds left the exchange between its Nov. 25 restart and Dec. 10, DefiLlama data show, a sign that some clients were unsettled by last month’s security incident. HTX said it lost $30 million worth of crypto tokens in the breach and temporarily suspended withdrawals and deposits following the attack.

An HTX spokesperson said the outflow is “a small fraction of our total reserves, indicating a stable and robust platform.” The exchange is committed to providing a “secure and seamless” trading experience, the spokesperson added.

Sun is also linked to the Poloniex platform and the HECO Bridge, a network set up by HTX to enable transfers between blockchains. Poloniex and HECO were hacked in November too, leading to the theft of about $200 million in crypto.

After the November HTX incident, Sun said in a post on X that a probe was underway and that the exchange would “fully compensate for HTX’s hot wallet losses.” Hackers also stole $8 million from the platform in September.

Top 20 Exchange

HTX, once known as Huobi, had average trading volume of $1.6 billion in the past 24 hours, putting it in the top 20 crypto exchanges by that metric, according to CoinMarketCap figures as of 6:25 p.m. on Dec. 10 in Singapore.

Digital-asset investors have become more attuned to shifts in flows and reserves at virtual-currency exchanges following the collapse of the FTX platform last year with a giant hole in its books.

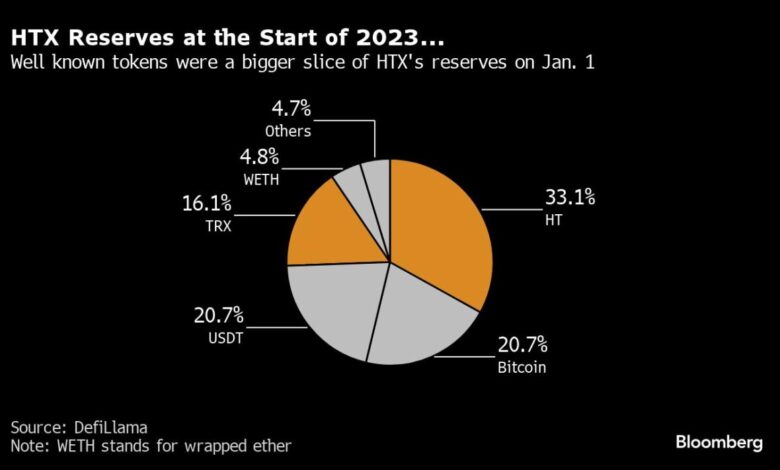

At HTX, the biggest chunk of reserves — about 33% — is comprised of Bitcoin, according to DefiLlama. About 32% is in the TRX token from the Tron blockchain, which Sun launched in 2017. HTX’s exchange coin HT accounts for some 14%, followed by a Sun-backed token called stUSDT on 12%.

TRX is at the center of US fraud allegations against Sun. The Securities and Exchange Commission in a March lawsuit accused him and his firms of market manipulation to make the token appear actively traded. Sun tweeted at the time that the suit “lacks merit.”

Security firm BlockSec said HTX recovered the $8 million stolen in September. Hackers still appear to control the $30 million taken last month, it added.

(Updates with comment from HTX in the third paragraph.)

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.

Source link