Down 25%, This Magnificent Artificial Intelligence (AI) Stock Is a Screaming Buy Before It Jumps 170%

[ad_1]

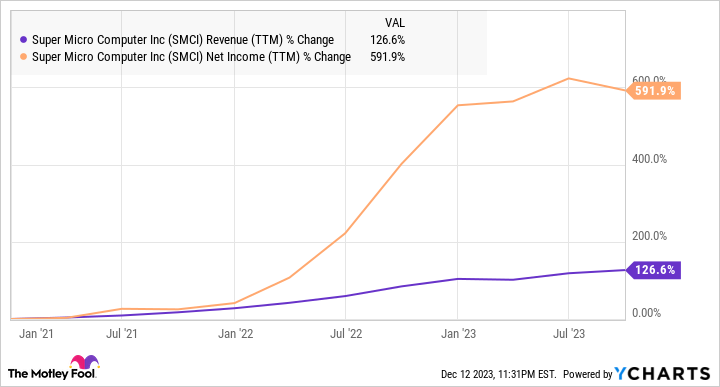

The artificial intelligence (AI) craze has driven Super Micro Computer (NASDAQ: SMCI) stock up significantly this year, with shares of the company that’s known for providing modular server solutions rising 222% in 2023 as of this writing. The good part is that investors still have an opportunity to add this high-flying stock to their portfolios.

After all, shares of Super Micro are down nearly 25% since hitting their 52-week highs in early August. Let’s see what’s dragging the stock down and check why this seems like an opportunity for savvy investors to buy a stock that could deliver eye-popping returns in the long run.

Its recent pullback doesn’t seem justified

Super Micro Computer’s fiscal 2023 fourth-quarter results, which were released in August this year, brought its red-hot rally to a screeching halt as investors weren’t enamored by the company’s soft guidance. But a closer look suggests that investors were simply looking for a reason to book profits as Super Micro delivered terrific growth and issued an encouraging outlook.

What’s more, Super Micro recently raised its full-year guidance to a range of $10 billion to $11 billion from the prior range of $9.5 billion to $10.5 billion. At the midpoint, this indicates a year-over-year revenue jump of 48% from fiscal 2023’s top line of $7.12 billion. That points toward an acceleration over the 37% revenue growth Super Micro delivered in the previous fiscal year.

Investors, however, seem to be influenced by other factors. For instance, Susquehanna analyst Mehdi Hosseini recently downgraded Super Micro stock to negative from neutral, citing margin pressure and its valuation. The analyst has a price target of $160 on the stock, which points toward a 40% drop from current levels.

However, the huge opportunity that Super Micro is sitting on in the AI server market could help accelerate the company’s already impressive earnings growth that it has been delivering.

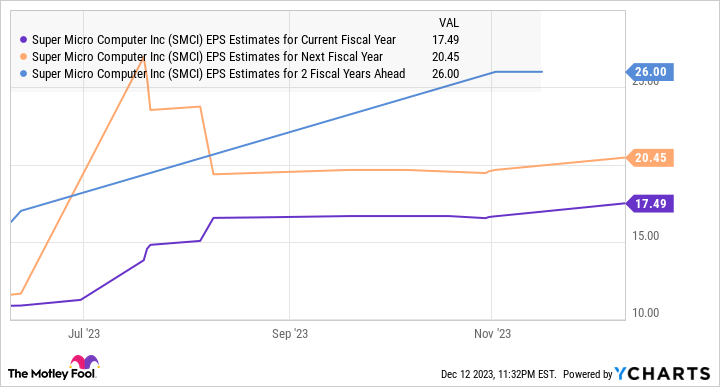

It is worth noting that Super Micro’s non-GAAP (adjusted) net income jumped a whopping 109% in fiscal 2023 to $11.81 per share. According to consensus estimates, Super Micro’s bottom line is likely to increase at a solid pace for the next three fiscal years as well.

Bears may argue that analysts are projecting Super Micro’s earnings growth to decelerate next year. However, the company’s focus on enhancing its manufacturing capacity could lead to stronger-than-expected growth, which also explains why its bottom-line growth is expected to accelerate in fiscal 2026. Super Micro recently raised its global capacity to 5,000 server racks per month from the prior level of 4,000.

Barclays analyst George Wang, who has an overweight rating on Super Micro stock, estimates that the company’s prior capacity of 4,000 racks a month could support annual revenue of $12 billion to $15 billion. So, a 25% increment in capacity means that Super Micro’s annual revenue potential should have ideally increased to a range of $15 billion to $19 billion.

What’s more, Super Micro management remarked on the previous earnings conference call that the new facility that it is building in Malaysia could take its annual revenue capacity to more than $20 billion. More importantly, Super Micro believes that it could hit that mark in the next couple of years.

An attractively valued AI stock with upside potential

Super Micro stock is very cheap right now for the growth that it has been delivering. The company trades at just 2 times sales and 24 times trailing earnings. The forward earnings multiple of just 7 points toward a sharp jump in its earnings.

Super Micro expects to generate $20 billion in annual revenue over the next couple of years, which wouldn’t be surprising given how fast the AI server market is growing. Foxconn, for instance, is forecasting 5x growth in the server market’s revenue to $150 billion in 2027, which translates into a compound annual growth rate of 50% over the next four years.

Super Micro is well-positioned to capitalize on this growth in AI server revenue as its rack solutions can be used by server operators to house popular AI chips from the likes of Nvidia, AMD, and Intel. Super Micro’s offerings are are in such solid demand because of the levels of customization it offers to customers, allowing them to make their servers more energy-efficient and cooler. This makes Super Micro’s server solutions ideal for deploying AI chips.

As such, it won’t be surprising to see Super Micro’s top line jumping to $20 billion over the next two to three years, considering how fast the AI server market is growing. If that happens, Super Micro’s market capitalization could jump to $40 billion based on its current sales multiple, which points toward a 170% upside from current levels.

That’s why investors looking to buy an AI stock right now should consider Super Micro now, considering the potential gains it could deliver.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 11, 2023

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool recommends Intel and Super Micro Computer and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, and short February 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

Down 25%, This Magnificent Artificial Intelligence (AI) Stock Is a Screaming Buy Before It Jumps 170% was originally published by The Motley Fool

Source link