[ad_1]

Even casual investors are likely well aware of Nvidia‘s (NASDAQ: NVDA) meteoric rise this year. The stock has skyrocketed by 235% since Jan. 1 as the company delivered multiple quarters of record earnings.

An explosion in demand for artificial intelligence (AI) applications saw the tech giant transform from a video games-centered company into one of the most powerful suppliers of data center chips. Nvidia has carved out a lucrative role in the industry thanks to its years of dominance in graphics processing units (GPUs). While competition in the software side of AI has grown intense, Nvidia is cashing in by supplying its hardware to the many companies joining the sector.

Despite the run-up in the company’s share price this year, Nvidia likely still has more growth to offer new investors. The AI market is expanding rapidly, with chip demand soaring right along with it.

Here’s why Nvidia is a screaming buy right now.

AI dominance that is unlikely to dissipate

According to Grand View Research, the AI market was valued at $137 billion in 2022 and is expected to expand at a compound annual rate of 37% until at least 2030. Those projections would see the sector exceed $1 trillion before the end of the decade, suggesting there’s plenty of room for Nvidia to remain atop the AI chip market and grow even as new players join.

Chipmakers like Advanced Micro Devices and Intel have products in the works that will challenge Nvidia’s near-total dominance in AI chips in 2024. However, taking a significant chunk out of Nvidia’s estimated 90% market share in AI GPUs will likely be an uphill battle. While its competitors have been scrambling to catch up, the company has become the gold standard in AI hardware.

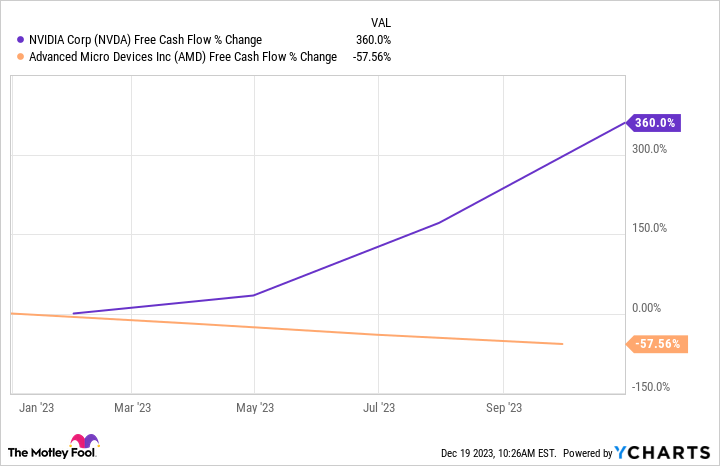

Moreover, Nvidia’s head start in AI has given it the funds to continue investing in R&D that can help it keep its lead and retain its dominance. Nvidia’s free cash flow has more than tripled this year, from $5 billion to more than $17 billion, while AMD’s has sunk from $3 billion to $1 billion. And Intel’s free cash flow has plunged by 150% since 2020, from $20 billion to a negative $10 billion.

In its fiscal 2024 third quarter (which ended Oct. 29), Nvidia’s revenue soared 206% year over year to $18 billion, with operating income up more than 1,600% to $10 billion. The company profited from a massive spike in AI GPU sales, as reflected in its 279% rise in data center revenue of $14 billion. AI chip demand is only likely to continue rising for the foreseeable future, and Nvidia is well-positioned to see significant gains for years.

Nvidia’s stock is nowhere near hitting its ceiling

There’s been much speculation on whether Nvidia can keep up its current growth trajectory. The 235% rise in its stock price this year will be challenging to replicate in 2024. However, a company doesn’t have to deliver the same percentage of share price growth year after year to be a stellar buy. And projections suggest Nvidia shares still have plenty of room left to run.

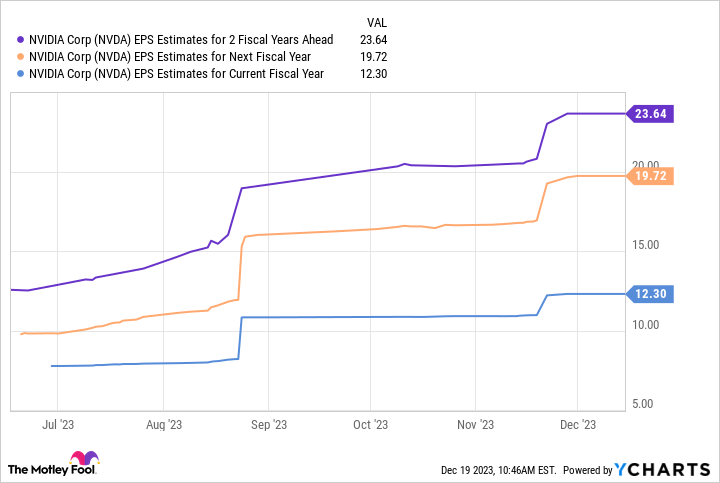

As the table above shows, estimates are that Nvidia’s earnings could hit nearly $24 per share by its fiscal 2026. When that figure is multiplied by the tech giant’s current forward price-to-earnings ratio of 45, it gives a stock price of $1,080, suggesting that if it continues to trade at today’s ratio, it could gain roughly 120% over the next two years.

As such, new investors could more than double their money over the next two years by investing in Nvidia today. That makes it a no-brainer buy, and one you won’t want to miss out on.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 18, 2023

Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, and short February 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

Is Nvidia Stock a Buy? was originally published by The Motley Fool

Source link