[ad_1]

Telecom giant AT&T (NYSE:T) is a contrarian bet for 2024. It’s arguably one of the most disliked stocks in the market right now, and it’s easy to understand why. The stock has badly underperformed the broader market for years, and in 2022, it cut its dividend payout. This hurt its standing with dividend investors, who account for a large portion of its shareholder base.

Of the 90 stocks in the S&P 500 (SPX) with market caps of over $100 billion, AT&T is the least-owned stock, so this stock won’t win any popularity contests in the near future. But when a stock becomes this unpopular, it’s often a good time to go against the grain and kick the tires. From this perspective, AT&T could be an enticing contrarian investment opportunity heading into 2024.

I’m bullish on AT&T based on its incredibly inexpensive valuation, compelling dividend yield (still massive even after last year’s reduction), improving debt profile, and surprisingly favorable outlook from analysts.

Remarkably Cheap

It’s hard to find many major stocks cheaper than AT&T. Shares trade at 6.9 times 2023 earnings estimates and 6.8 times 2024 earnings estimates. AT&T has disappointed investors for many years, so it’s not surprising that it trades cheaply, but this is a huge discount to the S&P 500 (SPX), which has an average price-to-earnings ratio of 21.8, three times AT&T’s valuation.

When stocks are this cheap, expectations are generally already low, and lots of bad news is already priced in. Speculation that Amazon (NASDAQ:AMZN) could get involved in the wireless industry and concerns that AT&T could face environmental liabilities over lead cables both drove shares lower in 2023. But neither of these concerns came to fruition, and their fallout is already baked into the share price. Conversely, just a bit of good news can often get a stock like this going again.

No one is going to mistake AT&T for a hot growth stock, but this valuation implies AT&T is a melting ice cube or a “cigar butt” investment, which isn’t the case, either. People are just as reliant on their cell phones and mobile devices as ever and likely will be for the foreseeable future. Revenue actually increased (albeit by a minor amount, from $30.0 billion to $30.4 billion) year-over-year during the most recent quarter, as did cash from operations (from $10.1 billion to $10.3 billion).

This is also a fairly recession-resistant business, as cellular service is one of the last expenses many would consider cutting; like it or not, cell phones have become a necessity of day-to-day life for most people.

Improving Balance Sheet

It should be noted that part of the reason that AT&T stock is cheap is because the stock is seen as having a heavy debt load.

However, this situation is improving. AT&T’s stable business produces a lot of free cash flow, and it has been using this excess cash flow, as well as proceeds from the divestiture of DirecTV and the spinoff of Warner Brothers (NYSE:WBD), to pay down debt. AT&T’s total debt has decreased from nearly $230 billion in March 2022 to just $155.7 billion as of the end of last quarter, a significant improvement.

The company’s debt-to-EBITDA ratio of 3.3 is high, but management’s goal is to lower it to 2.5 times by the first half of 2025. As AT&T continues to pay down debt, it could catalyze the share price. Furthermore, when leverage reaches management’s target level, AT&T can put this cash to use in other ways, such as share repurchases, which can serve as another catalyst for shares.

This is Still a Big-Time Dividend

Many dividend investors understandably soured on AT&T after it cut its dividend payout in 2022. While this was unfortunate for long-time shareholders who relied on the dividend, it’s important to realize that the damage has already been done, and this event is now in the rearview mirror.

Going forward, AT&T still features a massive 6.6% dividend yield, which is more than four times the dividend yield offered by the S&P 500 (currently 1.5%). It’s one of the top 20 dividend stocks in the S&P 500 by yield. Furthermore, the company’s payout ratio is reasonable, and its dividend cut is now water under the bridge, meaning that the dividend looks fairly safe, going forward. AT&T has also paid dividends to its shareholders for 27 consecutive years.

Is T Stock a Buy, According to Analysts?

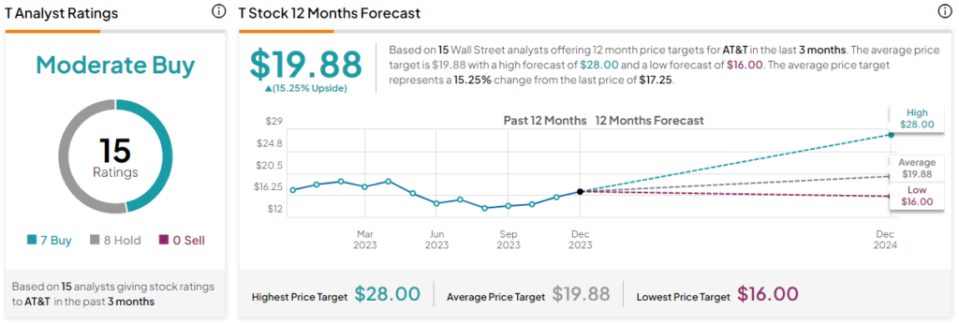

Turning to Wall Street, T earns a Moderate Buy consensus rating based on seven Buys, eight Holds, and zero Sell ratings assigned in the past three months. The average T stock price target of $19.88 implies 15.25% upside potential.

The highest forecast on the Street, a $28.00 price target from Tigress Financial’s Ivan Feinseth, implies even more significant upside potential of 62.3%.

The Takeaway: Smart Contrarian Play

AT&T is one of the least popular stocks in the market today. But look past the negativity, and you’ll see that there is a lot to like here.

The stock trades for a rock-bottom valuation and yields 6.6%. It has paid down a lot of debt and should continue to do so. It often pays to buy when there is blood in the streets, and AT&T looks like a classic example of that, making it an intriguing contrarian investment opportunity for 2024.

Source link