[ad_1]

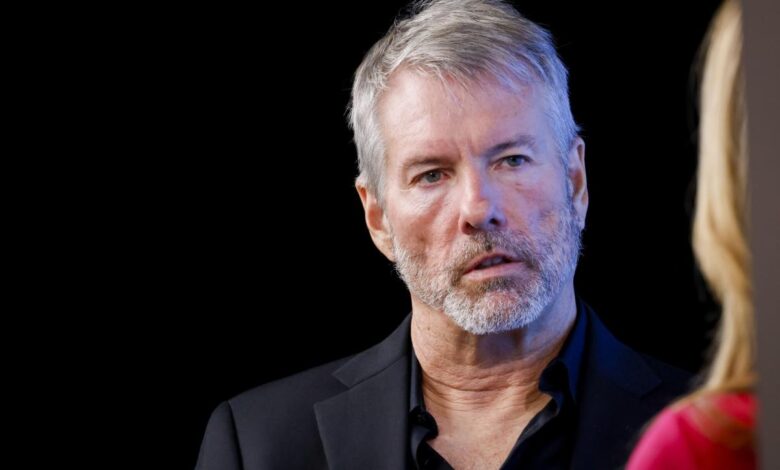

(Bloomberg) — MicroStrategy Inc.’s co-founder Michael Saylor has been selling company shares leading up to the US Securities and Exchange Commission’s approval of exchange-traded funds investing directly into Bitcoin.

Most Read from Bloomberg

The company’s executive chairman sold between 3,882 and 5,000 shares on certain days between Jan. 2 and Jan. 10, when the SEC made the announcement, data compiled by Bloomberg shows. The sales likely netted Saylor more than $20 million. It is the first time he has sold shares in nearly 12 years, the data shows.

A MicroStrategy spokesperson confirmed the sales noting that they are a part of a plan that was disclosed in a filing last year and is “separate from the recent ETF approvals.”

“The planned sales of up to 5,000 shares will occur each day between January 2, 2024 and April 26, 2024 under the plan,” the spokesperson said in a statement. The plan is to sell as much as 400,000 shares in that period.

Since the beginning of the year, MicroStrategy’s stock has fallen about 23%, partly on concerns that the ETFs’ debut could potentially make the company’s shares less attractive investments. Because the Tysons Corner, Va.-based company has carried Bitcoin on its balance sheet for several years, MicroStrategy has been viewed by many investors as a Bitcoin proxy. Prior to the SEC approving up to a dozen spot Bitcoin ETFs, investors couldn’t invest in the cryptocurrency directly. Now they have other options.

MicroStrategy began investing in Bitcoin in 2020, citing the need to reduce the company’s cash holdings because of the perceived eroding threat of inflation. The shift came as revenue from its software business stagnated.

During the last crypto winter, MicroStrategy had to take massive write-offs because of its Bitcoin holdings. The company’s Bitcoin holdings is currently worth $8.3 billion, about a 40% paper gain.

Bitcoin is up nearly 3% so far this year, briefly topping $49,000 for the first time since December 2021 after the ETFs began trading on Thursday.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Source link