[ad_1]

Some companies are just boring. They operate in dull industries where not much excitement happens. Because of that, they slowly plod along, often paying attractive dividends along the way.

However, slow and steady can win over the long term. That’s why some Fool.com contributors are rather excited about the total return potential of Black Hills Corporation (NYSE: BKH), Enbridge (NYSE: ENB), and Enterprise Products Partners (NYSE: EPD). While they operate in sleepy sectors of the energy industry, they have the potential to produce exciting total returns as they grow their earnings and dividends.

Black Hills just keeps chugging along

Reuben Gregg Brewer (Black Hills Corporation): It wouldn’t be at all shocking if you hadn’t heard of Black Hills Corporation. Not only is the name kind of nondescript, but it only has a $3.8 billion market cap, which makes it a small fry in the utility sector. However, what it lacks in size, it makes up for in consistency, most notably on the dividend front. This tiny utility just so happens to be a mighty Dividend King.

You don’t become a Dividend King by accident. It takes five decades of annual dividend increases to achieve that status. Only strong businesses can do that. And it helps to have a business that’s capable of growing over time; Black Hills’ customer growth is nearly three times the rate of population growth in the United States.

But here’s the really exciting part for conservative income investors: Black Hills’ 4.4% dividend yield is up near its highest levels of the past decade. That suggests that the stock is on sale right now. There are reasons for that, including rising interest rates and a pullback on capital spending in 2023. But for a company with a long-term record like Black Hills, these are likely to be temporary issues (capital spending, for example, is set to ramp back up in 2024). While this utility probably won’t excite you as a company, there’s a chance to collect a generous and growing income stream and for capital gains as the company gets back to investing for the future. On second thought, maybe Black Hills is more exciting than it sounds…

This sleepy business model generates high-octane total returns

Matt DiLallo (Enbridge): Enbridge has a pretty boring business model. The Canadian energy-infrastructure company gets about 98% of its revenue from cost-of-service agreements or long-term contracts. Nothing is exciting about those structures. However, they enable Enbridge to generate very predictable cash flow.

Enbridge will become even duller this year. It’s buying three sleepy natural gas utilities from Dominion in a $14 billion deal. That transaction will increase the company’s earnings from the anything-but-exciting natural gas utility sector to 22%. Most of its remaining cash flow will come from the equally drowsy pipeline sector, while 3% will come from the more interesting renewable-energy industry.

However, while Enbridge is a boring business, it has the fuel to produce exhilarating total returns. The company pays a high-yielding dividend (currently 7.4%) backed by its robust and steady cash flows. It typically pays 60% to 70% of its cash flow in dividends, retaining the rest to help its continued expansion. Enbridge estimates it has the financial capacity to make enough new investments to support around a 5% annual earnings-growth rate over the medium term.

That’s not a flashy growth rate. However, when added to its high-yielding dividend, it should give Enbridge the fuel to produce total annual returns in the low double digits. That’s a pretty exciting return potential from a sleepy company with a very low-risk profile.

A dividend growth stock you can bank on

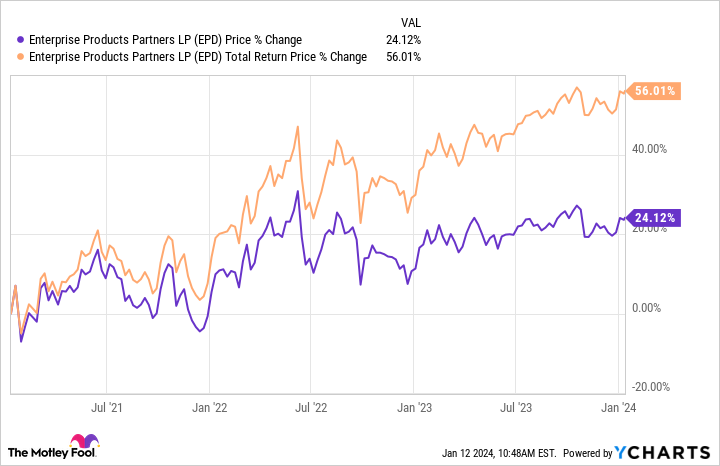

Neha Chamaria (Enterprise Products Partners): As a midstream energy-infrastructure company, Enterprise Products Partners’ cash flows may be somewhat immune to the volatility in oil and gas prices, but its stock price can still be volatile as investor sentiment toward the oil market fluctuates. The stock’s dividends, therefore, have contributed significantly to shareholders’ returns over the years.

Despite oil and gas prices fluctuating wildly in 2023, Enterprise Products’ stock earned nearly 18% returns with dividends reinvested. In the past three years, the stock’s total returns have been a solid 55%. Enterprise Products may seem like a boring stock, but its dividends could still make you a lot of money.

Of course, Enterprise Products’ business model is the biggest reason why its dividends are regular and stable. In fact, the oil and gas giant has increased its dividends every year for 25 consecutive years thanks to steady cash flows that it earns under long-term contracts for processing and transporting oil, gas, and related products. Despite lower commodity prices, the company’s volumes hit a record high in the third quarter, and that helped Enterprise Products keep distributable cash flow flat compared to year-earlier levels at $1.9 billion.

More importantly, Enterprise Products’ DCF covered dividends by 1.7 times in Q3, reflecting how safe this 7.5%-yielding stock’s dividends are. With management consistently investing in infrastructure while ensuring a strong balance sheet, this is one dividend stock that’ll likely deliver exciting returns in the long run.

Should you invest $1,000 in Enbridge right now?

Before you buy stock in Enbridge, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Enbridge wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 8, 2024

Matthew DiLallo has positions in Enbridge and Enterprise Products Partners. Neha Chamaria has no position in any of the stocks mentioned. Reuben Gregg Brewer has positions in Black Hills, Dominion Energy, and Enbridge. The Motley Fool has positions in and recommends Enbridge. The Motley Fool recommends Dominion Energy and Enterprise Products Partners. The Motley Fool has a disclosure policy.

Don’t Sleep on These Boring Dividend Stocks (They Could Deliver Exciting Returns) was originally published by The Motley Fool

Source link