[ad_1]

(Bloomberg) — Investors have pulled over a half of a billion dollars from the Grayscale Bitcoin Trust during its first days of trading as an ETF.

Most Read from Bloomberg

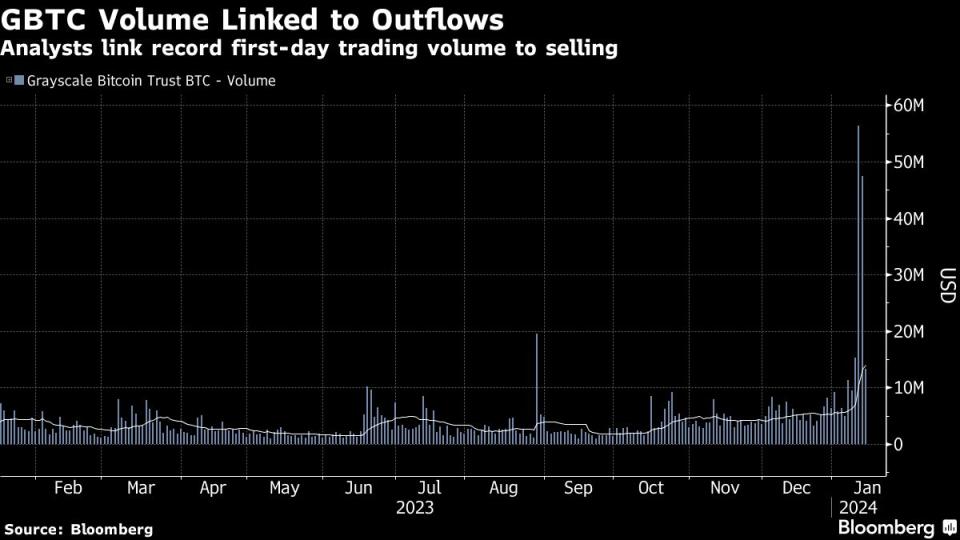

The fund, which won US Securities and Exchange Commission approval to convert to an ETF from a trust last week, has seen outflows totaling about $579 million, according to data compiled by Bloomberg. It’s a stark difference from the other nine spot Bitcoin ETFs, which have pulled in a total of nearly $1.4 billion.

“Thanks to the ETF conversion this is the first time we’ve had clear sight into flows of GBTC,” said James Seyffart, an ETF analyst at Bloomberg Intelligence, who noted that investors may be profit-taking.

The flow data is a more complete look at how the ETF fared in the wake of SEC approval. While over $2.3 billion of GBTC shares changed hands its first day, the outflows now indicate that a portion of that volume was due to selling.

“Grayscale has dominated the market for regulated Bitcoin investing for over a decade. Now that other issuers have come to market, we are naturally seeing some rotation into these new products,” said Zach Pandl, Grayscale’s managing director of research. “Total net inflows into Bitcoin investment products are what matters for prices, not substitution from one product to another.”

The outflows from Grayscale’s ETF aren’t entirely unexpected. Bloomberg Intelligence forecasted that the fund will drain over $1 billion over the coming weeks.

“Lots of this capital will find its way back into other Bitcoin exposures,” Seyffart said.

Some investors are fleeing to cheaper spot Bitcoin ETFs. With an expense ratio of 1.5%, GBTC is the most expensive US ETF that invests directly in Bitcoin. The second-most expensive fund, the VanEck Bitcoin Trust, charges 0.25%.

Other spot Bitcoin ETFs have all seen net inflows, with BlackRock’s IBIT pulling in nearly $500 million in its first two days of trading, and Fidelity’s FBTC getting roughly $421 million. The inflows suggest that even outside of potential seed funding from fund issuers, demand is strong for Bitcoin exposure in a physically backed ETF.

(Updates with comment from Grayscale. Earlier version corrected total amount of inflows for nine spot Bitcoin ETFs in second paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Source link