[ad_1]

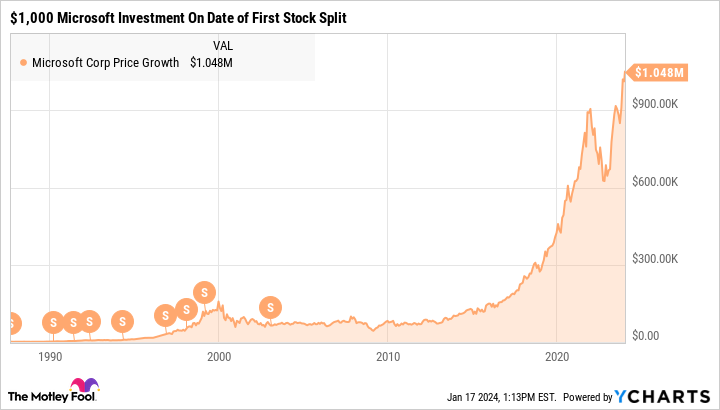

Tech-titan Microsoft (NASDAQ: MSFT) has executed nine stock splits over its long history. Let’s say you bought one share between the initial public offering (IPO) in 1986 and the first split in 1987. It would have multiplied into 288 stubs after all the splits. A $1,000 Microsoft investment on the day of that first stock split would be worth $1.05 million today:

It’s been a while since Microsoft took that route. As you can see in the chart above, the company hasn’t split its stock since February 2003, when the share count doubled for the last time.

Or maybe I should say, “For the last time so far.” Given Microsoft’s tremendous gains over the last 21 years, I wouldn’t be surprised to see a fresh stock split someday soon.

Mind you, I’m not holding my breath for this potential — but by no means guaranteed — event. Stock splits don’t add value or open up buying windows — they only make it easier to afford a single share. At the same time, a stock split often signals that the company’s board of directors and management team have high confidence that the stock will continue to rise, and that vote of confidence should be seen as good news.

Below, I’ll take a look at why Microsoft might want to take its stock down from its lofty perch, currently trading at $389 per share with a $2.9 trillion market cap.

AI is the main reason why Microsoft’s stock could split soon

The stock has done astonishingly well since OpenAI introduced the ChatGPT system to an unsuspecting world. Artificial intelligence (AI) has become a leading value driver across the tech sector, and Microsoft sits at the epicenter of this game-changing revolution.

The company has committed a $13 billion investment to OpenAI and the AI engine that drives ChatGPT runs on Microsoft’s Azure cloud-computing platform. Generative AI features are popping up all over the software mammoth’s product portfolio.

Microsoft is at the forefront of the AI revolution, with AI infusing everything from its Azure platform to enterprise software. This strategy is showing tangible results — a rapidly growing customer base for Azure AI services and potential revenue boosts from the AI-enhanced version of Microsoft 365. It’s not just a technological leap but a fundamental strategy shift with serious financial connotations.

It’s not the only ingredient in Microsoft’s financial cocktail, of course. The company should also benefit from the improving health of the global economy as inflation pressures fade away. In addition, the recently closed buyout of video game giant Activision Blizzard should drive important changes across the company’s entire business.

But nothing compares to the promise and potential of its AI expertise. In the words of Microsoft founder Bill Gates, “The development of AI is as fundamental as the creation of the microprocessor, the personal computer, the internet, and the mobile phone.” Securing a leading role in that revolution should drive Microsoft’s long-term growth to new heights.

These are the reasons why Microsoft might announce a stock split in 2024 as the company stands at the threshold of a whole new business era. Projecting strength with a stock split seems like a reasonable move — and those shares sure look pricey today. Why not cut the largest market cap of all into a larger number of slices?

How would a stock split change Microsoft’s shareholder value?

It’s no big deal if Microsoft doesn’t split its stock this year — or ever again, for that matter. Most stock brokerages support buying and selling fractional shares nowadays, and stock trades generally don’t carry transaction fees anymore.

If you only have $50 to invest in Microsoft this month, it’s very easy to place an order for one-tenth of a full share. The end result would be exactly the same as waiting for a 10-for-1 stock split and then buying a single stub.

Nobody knows whether Microsoft will go for a stock split at this point, and stock prices may change by a lot before then. You can make a fractional-share trade today at firmly established share prices.

Microsoft could very well announce a stock split someday soon. Feel free to buy, sell, or hold the stock according to your own analysis until that long-awaited split comes along — and don’t let it change your investment thesis too much. A confident leadership team can be good news, but that’s the only investable quality I see in stock splits.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for two decades, Motley Fool Stock Advisor, has more than tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now… and Microsoft made the list — but there are 9 other stocks you may be overlooking.

*Stock Advisor returns as of January 16, 2024

Anders Bylund has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Microsoft. The Motley Fool has a disclosure policy.

Stock-Split Watch: Is Microsoft Next? was originally published by The Motley Fool

Source link