[ad_1]

Finding stocks that not only promise growth but also offer consistent dividends isn’t always easy, especially in the growth-oriented tech sector. However, a few generous dividend payers stand out as great income investments right now. Three Fool.com tech writers are here to share their best dividend ideas right now.

Read on to get the deep-dive dividend details on Qualcomm (NASDAQ: QCOM), Universal Display (NASDAQ: OLED), and Microchip Technology (NASDAQ: MCHP). Each one offers a tantalizing blend of technology leadership, potential for long-term business growth, and a solid history of dividend growth.

Ample cash is a top reason to own this top chip stock

Nicholas Rossolillo (Qualcomm): By now, you’ve probably heard that the semiconductor industry has been in a deep slump since the second half of 2022, led downward by consumer electronics. Qualcomm, a leader in mobile chips and the underlying technology that enables mobile devices, has taken it on the chin. Revenue fell 19% in fiscal year 2023 (which ended in September 2023), including a 24% year-over-year dive in sales in the final months of the fiscal period.

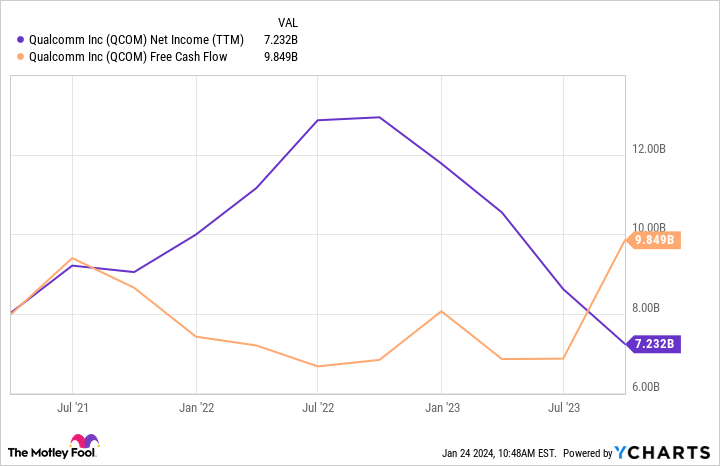

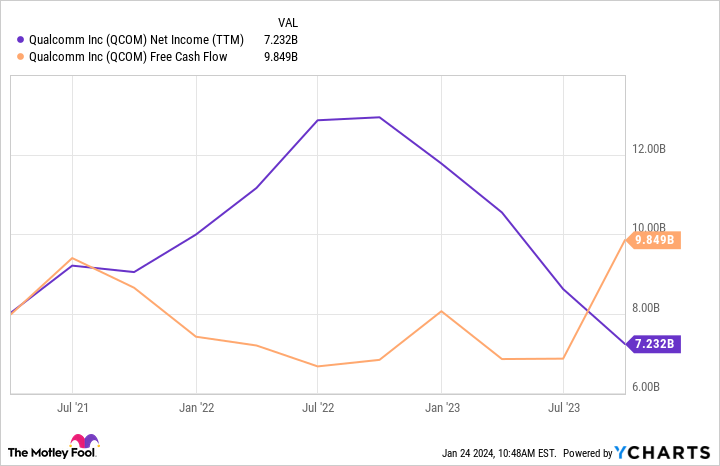

And yet, Qualcomm remained highly profitable by all metrics during the downturn last year. Not all top semiconductor companies could brag about that.

In fact, thanks to a record increase in its inventory of chips, and some of that inventory now getting sold to customers, Qualcomm refilled its coffers. Cash and short-term investments went from $6.4 billion at the end of fiscal 2022 to $11.3 billion at the end of September 2023. And along the way, Qualcomm actually increased its dividend, returning a record $3.46 billion in cash to shareholders last year — currently good for an annualized dividend yield of 2.1%.

Qualcomm also doles out excess cash generated from its business in the form of stock repurchases. Last year, that cash returned via repurchases was $3 billion, another 2% of the current market cap.

Free cash flow (from which dividends and stock buybacks are made) totaled nearly $10 billion in fiscal 2023. And with the smartphone market much healthier than in times past, Qualcomm could post an equally good year in 2024, leaving ample room for another dividend payout increase or more stock buybacks. This is one of the top reasons I’ve been adding to my position in this top mobile chip stock to start the new year.

The dividend champ you didn’t know you needed

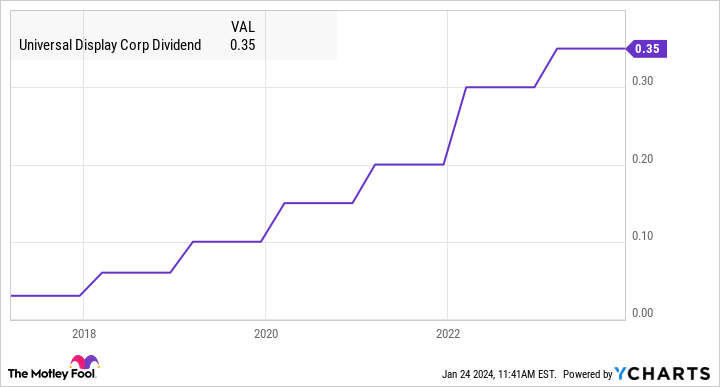

Anders Bylund (Universal Display): Once upon a time, it seemed kind of silly to talk about Universal Display as a dividend investment. The display technology expert’s first payout came in February 2017, offering a modest $0.03 per share. The forward yield worked out to a meager 0.2% at the time, based on a share price of roughly $67. That policy is hardly worth the paper it’s written on, right? I mean, a company developing the patent-protected technologies behind organic light-emitting diode (OLED) screens must be a high-growth tech stock, not a sleepy dividend play.

Well, you can actually have it both ways.

Dividend investments require a stern focus on a time horizon many years away. Universal Display powered its payouts from a surprisingly deep well of free cash flows, promising hefty dividend increases over the years. Nearly seven years and six payout increases later, the forgettable dividends of old have grown to a respectable $0.35 per quarter or $1.40 annually.

That works out to a 0.8% yield if you’re buying in at today’s prices, around the $180 mark. But if you picked up a few Universal Display shares when the payouts started, you’re looking at an effective annual yield of 2.1% on that investment. The company’s original position in my current portfolio, started almost exactly 12 years ago, now provides a 4.3% yield against the starting price of $32.41 per share.

You see, it’s all about those free-flowing cash profits and the company’s commitment to splitting that extra cash with shareholders. I expect another payout bump next month, as the company tends to announce each year’s first payout near the end of February.

The dividend increases have averaged 53% across the six existing bumps, including a 17% boost on the heels of the ghastly market trends in 2022. Free cash flows look a little soft right now due to Universal Display’s mid-2023 buyout of 550 OLED patents from German science and materials giant Merck KGaA. That deal made a $66 million dent in Universal Display’s cash flows in last year’s second quarter, but the cash profits are already trending upward again.

On top of Universal Display’s top-quality dividend policy, the company is poised to make a mint in a stabilizing economy, as consumers start looking for new phones and high-end TV sets again. Furthermore, the company’s target market should expand significantly in the coming years thanks to upgraded manufacturing processes, wider availability of OLED-based lighting panels, and new categories of electronics getting the power-sipping OLED upgrade.

These catalysts should send Universal Display’s stalled price chart higher in the coming years. The time to buy is now, before that potential hockey-stick moment plays out. Universal Display’s increasingly generous dividends may never be this affordable again.

This chip stock is increasing its dividend every quarter

Billy Duberstein (Microchip): AI-related chip and equipment stocks are rocketing to all-time highs. However, industrial and auto-related chips, which had been resilient throughout 2022 and for much of 2023, are now entering their post-pandemic correction. So that part of the market may be a good place to look for dividend tech stocks.

Microcontroller and analog chipmaker Microchip just preannounced its December-ended quarter, indicating that revenue would be down 22%, as opposed to its November guidance of down 15% to 20%. Management indicated the shortfall was due to a combination of customers cutting back inventory in response to a weakening demand environment, as well as some extended holiday shutdowns, which caused some shipments to move from the December-ended quarter to the March-ended quarter.

The strange thing is that the day after that announcement, Microchip’s stock was actually up. When a chip stock doesn’t go down or actually goes up on bad news, it usually means investors think it is nearing the bottom of the current cycle.

Despite the cyclicality that all chip companies experience, Microchip is fast becoming a high-margin blue chip name, so to speak, ever since it hit its target leverage a couple of years ago. That milestone came after five years of paying down the debt stemming from its huge 2018 Microsemi acquisition. But since hitting its leverage target, the company has turned to steadily ramping share repurchases and dividends, not just every year, but every quarter.

The plan is to increase cash returns to shareholders by 500 basis points as a percentage of free cash flow every quarter. In the latest quarter, Microchip returned $562 million to shareholders in dividends and repurchases, a figure that represented 77.5% of the previous quarter’s free cash flow. Those cash returns will increase 5 percentage points every quarter until reaching 100% by March of 2025.

That means investors should look for Microchip’s current 1.92%-yielding dividend to grow consistently. After all, while the auto and industrial sectors are taking a pause right now, Microchip should be a low-double-digit compounder as autos and industrial equipment utilize more and more chip content every year.

Meanwhile, Microchip’s stock trades at a very reasonable 20 times forward earnings estimates, and those estimates should indicate the trough of the cycle. That makes the stock a smart pickup for dividend growth investors in early 2024.

Should you invest $1,000 in Qualcomm right now?

Before you buy stock in Qualcomm, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Qualcomm wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 22, 2024

Anders Bylund has positions in Universal Display. Billy Duberstein has positions in Microchip Technology. His clients may own shares of the companies mentioned. Nicholas Rossolillo has positions in Microchip Technology, Qualcomm, and Universal Display. The Motley Fool has positions in and recommends Qualcomm. The Motley Fool recommends Universal Display. The Motley Fool has a disclosure policy.

3 No-Brainer Dividend Stocks to Buy Now and Hold Forever was originally published by The Motley Fool

Source link