[ad_1]

Sports betting stock DraftKings (NASDAQ: DKNG) has been red-hot of late. Shares are up to the tune of 140% for the past 12 months after its wagering app was made available in several new U.S. states. Indeed, the rally’s been so strong that some interested investors may be wary of stepping into a new DraftKings position now.

Don’t be. While this stock is apt to remain volatile in the foreseeable future, the bulk of that volatility is likely to remain bullish. Here’s a look at the three top reasons why.

1. More sports-betting legalization is on the way

Certainly much of DraftKings’ 75% revenue growth through the first three quarters of last year is organic growth. But much of this growth can also be attributed to the fact that a number of states officially legalized sports betting in 2023. Kentucky, Pennsylvania, and Massachusetts are some of last year’s new entrants, and the company continued to refine its marketing in regions where sports wagering was legalized before last year.

For all the legalization progress that’s been made, though, a bunch of states have yet to legalize online sports betting — including the enormous state of California. Information compiled by Legal Sports Report suggests 38 states have authorized some sort of sports wagering, leaving 12 more (and some additional territories) left to tap.

And for the record, while it may not yet be legal everywhere, almost every state has at least entertained legislation that would allow it since the U.S. Supreme Court struck down the long-standing federal ban on sports betting back in 2018. Straits Research believes the worldwide sports betting market will grow at an annualized pace of more than 11% through 2032, jibing with outlooks from Mordor Intelligence as well as Polaris Market Research.

Also for the record, DraftKings has already proven it’s capable of growing its market share within this growing arena. As of the third quarter, the company reports it controls 33% of the United States’ online sports betting and iGaming market, up from 25% a year earlier.

2. DraftKings is making progress on profits

Like so many other young companies, DraftKings has been operating in the red for most of its existence. While that’s not been a catastrophic impediment to the stock’s value, continued losses clearly don’t work in its favor either. Plenty of investors simply don’t want to take a chance on a company that’s yet to prove it can become and remain fiscally viable.

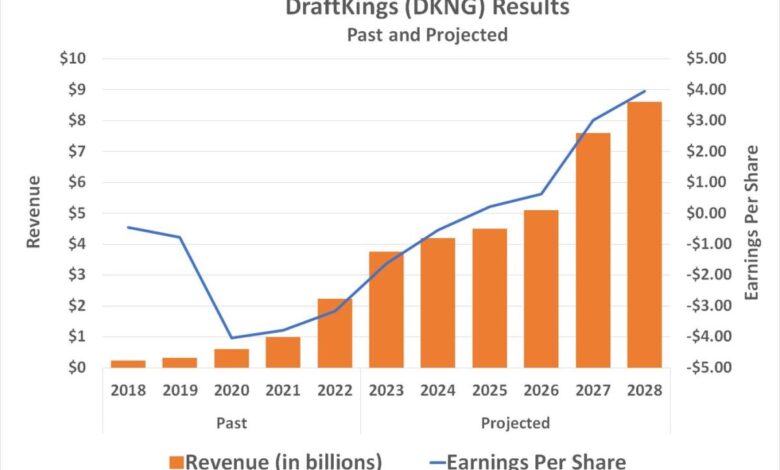

Sometimes though, tangible progress toward profitability is enough to draw would-be buyers in. DraftKings is clearly making such progress. The total operating losses of $745 million through the first three quarters of 2023 are more than $500 million less than the $1.3 billion loss the company was nursing at the same point a year earlier. Better yet, its first net profit is predicted for the fourth quarter of last year. Those numbers should be released in mid-February.

This is still just the beginning, however. While the analyst community still expects a full-year loss in 2024, a permanent swing to profitability is predicted for 2025. Profit margins should only continue to widen from there, outpacing the long-term revenue growth predicted for DraftKings.

Actual earnings of course bolster the bullish argument. However, the company doesn’t actually have to be profitable yet to spur interest in the stock. Clear progress toward this end zone can be enough.

Side note: Much of this potential margin explosion stems from continued growth in markets where DraftKings has already been operating for a year or more. The company spends heavily to establish a presence in a state once it can legally do so. Once those roots — and relationships — are established though, per-user costs should drop dramatically.

3. (More) partnerships are in the works

While much of DraftKings’ growth since it was founded back in 2012 is the result of drawing droves of sports fans directly to its app, that’s not necessarily how the company will continue to drive the bulk of its growth in the future. It’s increasingly finding marketing partners to help it establish and then grow its presence in a particular market or demographic.

Take October’s announcement of a new sportsbook being planned for Maine as an example. Although not able to directly enter the market with its sports betting app, the company is able to work with Maine’s Passamaquoddy Native American tribe to bring legal sports betting to the state. In August, DraftKings co-launched online casino gaming with the Golden Nugget casino in Pennsylvania.

Perhaps the next compelling prospective partnership DraftKings could forge, however, is the one rumored just a few days back. While neither company has confirmed they’re even talking with one another, whispers that DraftKings could be teaming up with Barstool Sports aren’t beyond the realm of being believable. Sports media brand Barstool recently unwound a tie-up with Penn Gaming, and could now be looking for a new way to monetize its huge fan base that already uses Barstool’s platform to find sports wagering odds and to get help making fantasy sports picks.

Whether or not anything comes of the Barstool Sports rumors though, DraftKings is clearly a brand name with enough cache to forge meaningful partnerships.

Not for everyone, but certainly for some

A perfect pick for everyone? No, DraftKings stock can still be considered an aggressive growth pick with above-average risk. If you’re looking for safety, value, or income, look elsewhere.

If you’ve got a bit of tolerance for volatility, however, this ticker’s potential upside is arguably greater than its measurable risk. Just bear in mind you’ll need to hold it for a few years to maximize this potential while minimizing its risk.

Should you invest $1,000 in DraftKings right now?

Before you buy stock in DraftKings, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and DraftKings wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 29, 2024

James Brumley has no position in any of the stocks mentioned. The Motley Fool recommends the following options: long January 2025 $25 calls on Penn Entertainment and short January 2025 $30 calls on Penn Entertainment. The Motley Fool has a disclosure policy.

3 Reasons to Buy DraftKings Stock Like There’s No Tomorrow was originally published by The Motley Fool

Source link