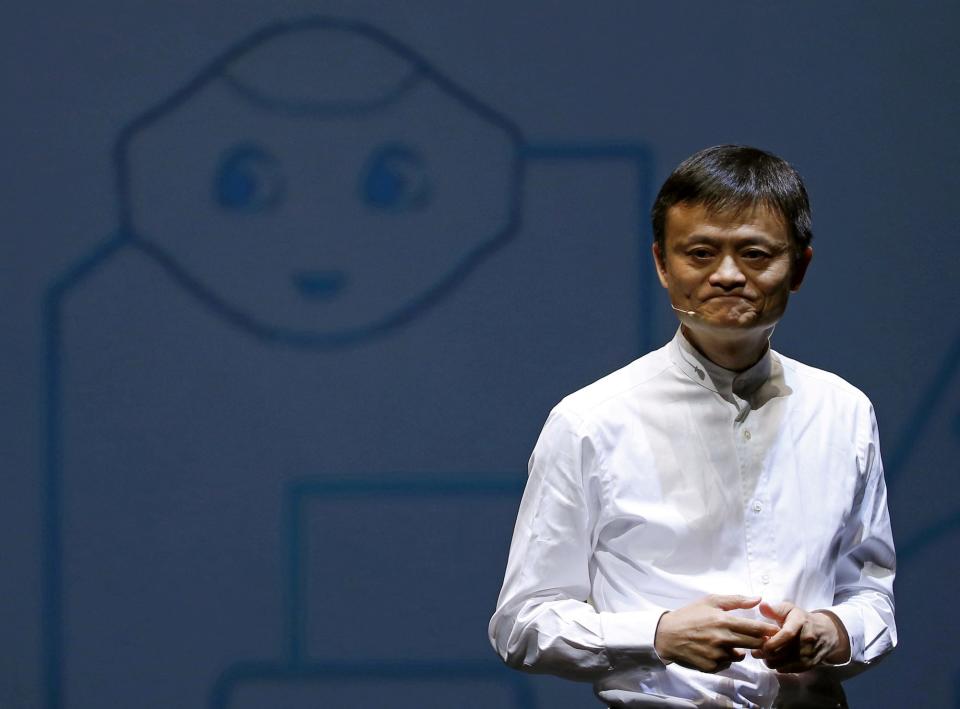

Alibaba’s stock dropped so much that Jack Ma reversed a plan to sell shares for his other investments

[ad_1]

-

Alibaba cofounder Jack Ma walked back on plans to sell the company’s stock.

-

The Chinese tech giant’s stock crashed last week after it nixed a plan to spin off its $11 billion cloud business.

-

Ma’s family trust was set to sell 10 million shares this week.

Alibaba cofounder Jack Ma reversed plans to sell the company’s stock following a slump in its stock price last week.

The Chinese tech giant dropped plans to spin off its $11 billion cloud business last Thursday. The company’s stock sank in response, wiping out $26 billion in value over two days.

Ma’s family trust was set to sell 10 million American Depository Shares of the company worth $870 million on Tuesday. The regulatory filings for the sale were also made public on Thursday, weighing on investor confidence.

The company’s employees were also concerned about Ma’s move, Reuters reported on Wednesday.

But Alibaba appeared to be shoring up staff confidence with an internal memo assuring them that Ma “has not sold a single share,” according to media reports.

“Ma’s office has issued a statement saying that Ma will continue to hold onto his Alibaba stake. This is a fact and not mere lip service,” chief people officer Jane Jiang Fang said in the note, per Bloomberg.

Ma’s family office was planning to use the funds to invest in agriculture and charities, Jiang added.

But Ma isn’t selling the stock since its current value is lower than its actual value, she said in the memo. She added that the timing of the disclosure was a “coincidence” that caused a “severe misunderstanding.”

On Friday, Ma’s office told the South China Morning Post that he remains “very positive” about Alibaba. Alibaba owns SCMP.

Ma has been selling down his Alibaba stake since leaving the company’s board in 2020. He stepped down as CEO in 2019.

The share sell-off last week was Alibaba’s sharpest in over a year. The stock’s decline has taken Ma’s fortune down to around $30 billion — down 9% year to date, according to the Bloomberg Billionaires Index. Ma, who was once Asia’s richest person, was worth $60 billion at the peak of his fortune in late October 2020.

Alibaba’s share price has been under pressure since Ma’s criticism of Beijing triggered a backlash on his companies in late 2020. The tech titan — who was known for his flamboyant personality — also vanished from public view.

Separately, China also cracked down on the country’s tech sector in 2020, wiping $1.1 trillion off the market value of five of its Big Tech companies: Alibaba, Tencent, Meituan, Baidu, and JD.com as of July — before Beijing signaled an easing of regulatory actions in the same month.

Alibaba shares in the US closed flat at $78.96 on Wednesday. They are down 10% this year-to-date.

Alibaba did not immediately respond to a request for comment from Business Insider.

Read the original article on Business Insider

Source link